疫情时代国际航空业及航空保险业的发展报告

疫情时代国际航空业及航空保险业的发展报告

REPORT OF THE INTERNATIONAL AVIATION INDUSTRY AND AVIATION

INSURANCE INDUSTRY DEVELOPMENT IN THE AGE OF COVID-19

组织编写:中国银行保险报

ORGANISING&EDITING GROUP:CHINA BANKING AND INSURANCE NEWS

智力支持:扬子江保险经纪

INTELLECTUAL SUPPORT:YANGTZE RIVER INSURANCE BROKERS CO.,LTD.

2020年12月

DECEMBER 2020

目录 Content

前言.............................................................................4

Foreword.........................................................................4

报告摘要.........................................................................7

Executive Summary................................................................7

一、 疫情时代的国际航空业.........................................................9

COVID-19’s Impact on International Airline Industry.............................9

1.1 新冠疫情对国际航空运输业的总体影响.............................................9

The Overall Impact of COVID-19 to International Airline Industry.................9

1.2新冠疫情对航空公司的影响.......................................................15

The Impact of COVID-19 to Airlines...............................................15

1.3新冠疫情对航空制造业的影响.....................................................18

The Impact of COVID-19 to Manufacturers..........................................18

1.4新冠疫情对租赁公司的影响.......................................................20

The Impact of COVID-19 to Lessors................................................20

1.5国际航空运输业恢复情况及地区间对比..............................................20

Recovery of International Aviation Industry and Comparison among Regions.........20

1.6国际航空运输业未来展望.........................................................22

Future Outlook of International Aviation Industry................................22

二、中国航空运输业的情况..........................................................23

Current Situation of Chinese Aviation Industry...................................23

2.1 中国航空运输业恢复情况........................................................23

The Recovery of Chines Airlines Industry.........................................23

2.2 各航司恢复情况对比............................................................24

Recovery Status Comparison among Airlines........................................24

三、航空保险业的挑战与机遇........................................................27

The Challenges and Opportunities of Aviation Insurance Industry..................27

3.1 疫情对航空风险的影响 – 飞机机身..............................................28

The Impact on Aviation Exposure - Hull..........................................28

3.2 疫情对航空风险的影响 – 旅客与货邮............................................30

The Impact on Aviation Exposure – Passenger, Cargo and Mail.....................30

3.3 2020年航空险市场情况分析 – 承保能力减少......................................35

Analysis of Aviation Insurance Market – Reduction in Capacity...................35

3.4 2020年航空险市场情况分析 – 保险保障的调整.....................................38

Analysis of Aviation Insurance Market – Coverage Changes........................38

3.5 2020年航空险市场情况分析 - 费率上涨...........................................40

Analysis of Aviation Insurance Market – Rate Increase...........................40

3.6国际航空保险市场发展趋势.......................................................45

Development trend of international aviation insurance market.....................45

结语.............................................................................46

Concluding Remarks...............................................................46

鸣谢Acknowledgement..............................................................47

扬子江保险经纪有限公司............................................................47

Yangtze River insurance brokers Co., Ltd.........................................47

前言

Foreword

2020年新冠肺炎疫情的爆发,对全球各行各业带来了巨大的冲击,新冠疫情全球大流行对全球经济造成了严重破坏,其破坏程度超过了2008年的国际金融危机。据国际货币基金组织(IMF)2020年10月份发布的《世界经济展望》预测,2020年全球经济将萎缩4.4%,发达经济体将萎缩5.8%,新兴经济体将萎缩3.3%。2020年,超过95%的国家人均收入预计都将出现负增长。根据IMF最新预测,中国将是世界主要经济体中唯一保持正增长的国家。世界银行6月的《全球经济展望》预测,2020年全球经济将下滑5.2%,是“二战以来最严重的经济衰退”,也是1870年以来人均产出下降的经济体数量最多的一年。

The outbreak of the COVID-19 in 2020 brought a great impact on all industry in the world. The global pandemic of the COVID-19 has seriously damaged the global economy, which has exceeded the international financial crisis in 2008. According to the world economic outlook released by the International Monetary Fund (IMF) in October 2020, the global economy will shrink by 4.4%, developed economies by 5.8% and emerging economies by 3.3%. In 2020, more than 95% of the countries' per capita income is expected to show negative growth. According to the latest IMF forecast, China will be the only major economy in the world to maintain positive growth. According to the world bank's global economic outlook in June, the global economy will decline by 5.2% in 2020, which is the "most serious economic recession since World War II" and the largest number of economies with declining per capita output since 1870.

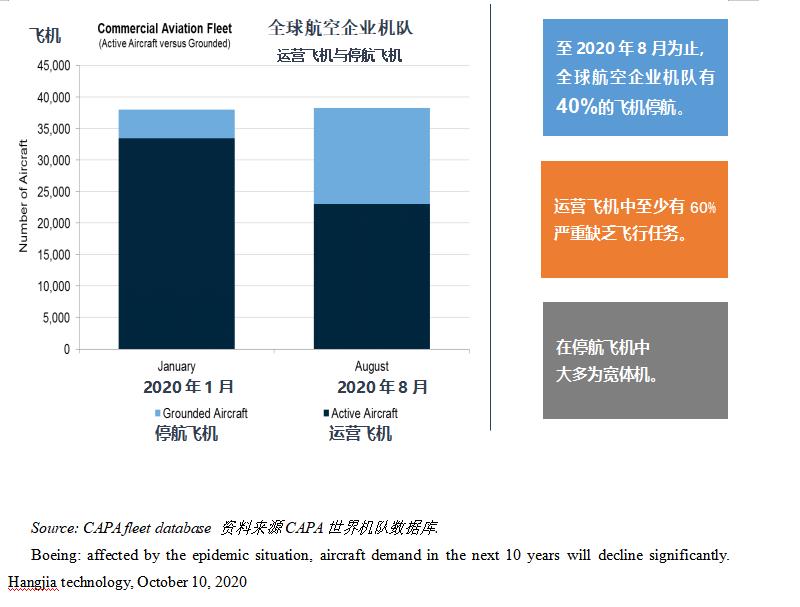

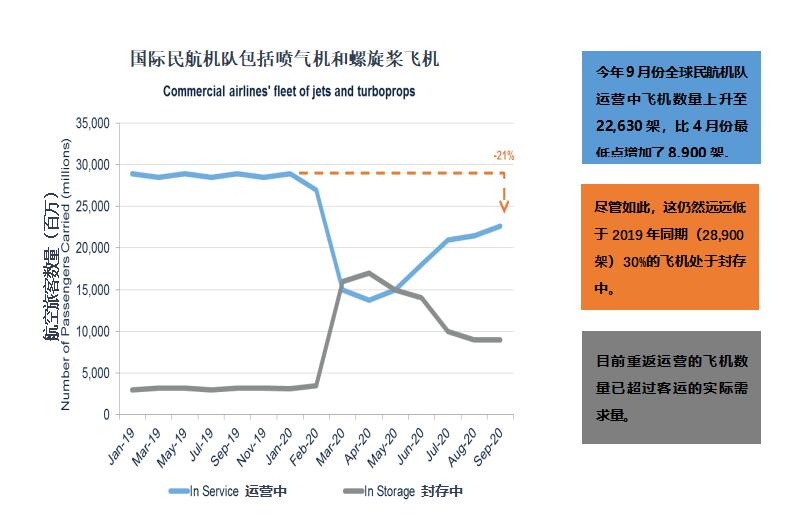

航空运输业在此次疫情中更是遭受了灾难性的打击。今年4月,全球约65%(8000多架)的飞机停场。4月份后,随着航班缓慢恢复,情况有所好转,但10月份的数据显示,全球仍有约43.8%的飞机停场。

The air transport industry has suffered a disastrous blow in this epidemic. In April, about 65% (about 8000) of the world's aircraft are grounding, and the situation improved while the flights slow recovery, but as the data of the October showed that about 43.8% of the world's aircraft still grounded.

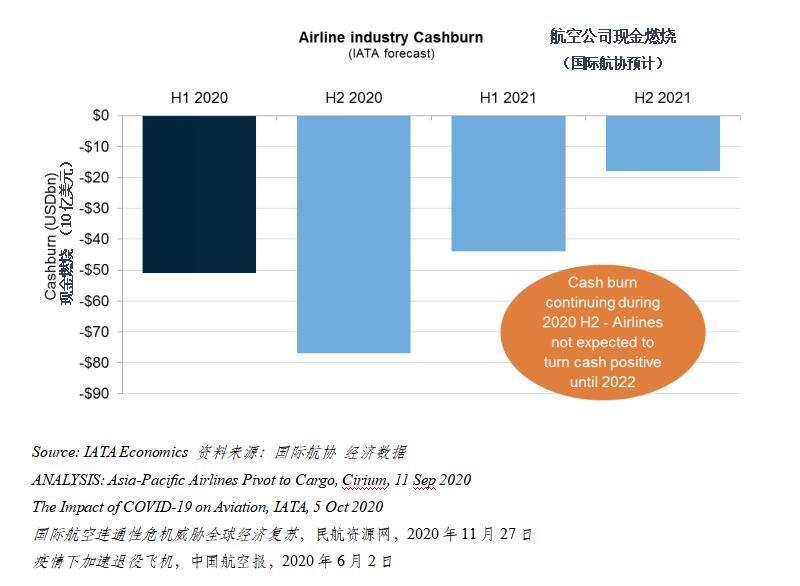

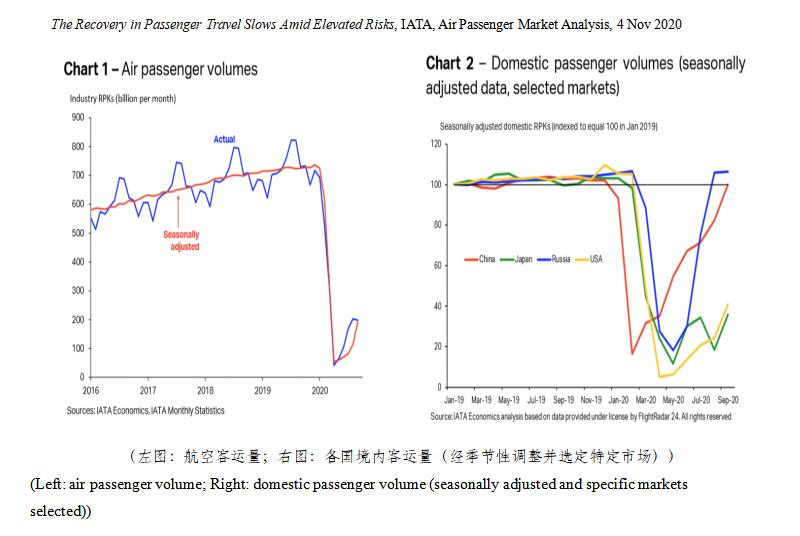

民航客运市场经历了二战以来,甚至自民用航空运输史以来最大的打击,而疫情的不断反复阻碍了危机的恢复。4月份,全球RPK降幅高达94%,2020年预计全球RPK平均下降66%。4月后,全球客运市场从低谷中缓慢恢复,国内航空旅行有明显改善,但国际客运的复苏依然遥遥无期。此外,运量增长未能赶上航司的运力增速,市场仍处于一种供大于求的状态,虽然航司仍然在飞,但客座率和票价都低于过去的水平,现金消耗仍在继续。

The civil aviation market has experienced the heaviest blow since World War II and even since the history of civil aviation transportation, the repeated epidemic situation has hindered the recovery of the crisis. In April, the global RPK dropped by 94%, and it is expected that the global RPK will decrease by 66% on average in 2020. After April, the global passenger transport market recovered slowly from the trough, and domestic air travel improved significantly, but the recovery of international passenger transport is still far away. In addition, the growth of traffic volume failed to catch up with the capacity growth of airlines, and the market is still in a state of oversupply. Although airlines are still keep on operating the flight, the seat rate and ticket price are lower than the previous levels, and the cashburn is still continuing.

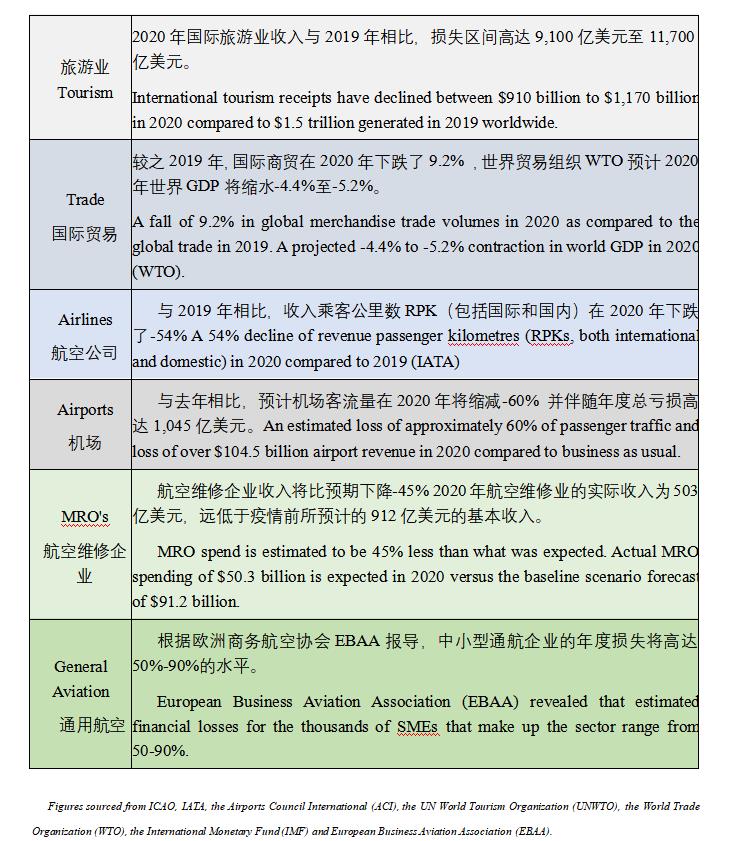

航空运输对于全球供应链、贸易、旅游、投资以及各种商务活动都具有重要作用。在此次疫情的沉重打击下,今年全球航空相关行业的收入预计将损失了4190亿美元,航空公司净亏损预计高达1185亿美元,4600万个航空相关岗位处于危险之中,已有至少43家航司倒闭。当前,出入境限制措施仍未大范围放松,国外疫情仍在发酵,疫苗的普及尚需时日,多重不确定性因素正在制约着航空运输的重启和恢复。国际航协预测,全球航空客运需要到2024年才能恢复到2019年的水平。

Air transportation plays an important role in global supply chain, trade, tourism, investment and various business activities. Under the heavy blow of the epidemic, the revenue of the related industries of global aviation is expected to lose 419 billion US dollars this year. The net revenue loss of airlines is expected to be as high as 118.5 billion US dollars. 46 million jobs related of aviation are in danger, and at least 43 airlines have closed down. At present, the entry-exit restrictions have not been relaxed on a large scale. The epidemic situation of oversea is still fermenting, and the popularization of vaccines still need more time. Multiple uncertain factors are restricting the restart and recovery of air transportation. According to the prediction of IATA, global air passenger transport will not return to the level of 2019 until 2024.

面对史无前例的灾情,国内各航空公司不畏艰难,积极应对,迅速参与到全国的抗疫活动中。如海航集团,疫情爆发后,立即以战时速度、战时状态贯彻执行党中央及各级党委、政府的决策部署,共执飞医疗救援包机46班,接滞留海外人员回国等各类包机57班,复工复产包机30班。运输疫情防控物资约5400吨,累计投入运输成本约1.5亿元,为夺取抗击新冠肺炎疫情的阶段性胜利做出了巨大贡献。

Regarding of the unprecedented disaster, airlines face up to the difficulties, and actively respond, participate in the national anti epidemic activities quickly. For example, after the outbreak of the epidemic, HNA immediately implemented the decision-making and deployment of the government at all levels at the first time. HNA carried out 46 charter flights for medical rescue, 57 charter flights for overseas personnel’s returning , and 30 charter flights for resumption of work and production. About 5400 tons of novel coronavirus pneumonia were transported. The total cost of transportation was about 150 million yuan, which made a great contribution to the victory of fighting against the the COVID-19.

同样,面对灾难性的新冠疫情,国际航空保险业也承受着巨大的经营压力,多年来的承保亏损,未来承保能力的进一步萎缩,新的未知风险的增加,使国际航空保险的承保人不得不思考新的承保策略。

At the same time, in the face of the catastrophic COVID-19, the international aviation insurance is also under a heavily business pressure, underwriter’s losses still keep on over the years, further shrinkage of the future underwriting capacity, and the increase of unknown risks make the international aviation underwriter have to think about new strategies.

本报告通过“疫情时代的国际航空业”分析了疫情对国际航空业的冲击,近几个月中全球航空业的复苏情况以及对国际航空运输业未来的展望。通过“中国航空运输业的情况”呈现了中国航空运输业的恢复情况。通过“航空保险业的挑战与机遇”分析了疫情对航空风险的影响-飞机机身、疫情对航空风险的影响-旅客与货邮、2020年航空险市场情况,并展望了疫情影响下航空保险的市场前景。

This report analyzes the impact of the epidemic on the international aviation industry, the recovery of the global aviation industry in the past months, and the outlook for the future of the international air transport industry. Through the "situation of China's air transport industry", it shows the recovery of China's air transport industry. Based on the "The Challenges and Opportunities of Aviation Insurance Industry", this part analyzes the impact on Aviation Exposure - Hull, the impact on Aviation Exposure – Passenger, Cargo and Mail, aviation insurance market situation in 2020, and forecasts the development trend of international aviation insurance market.

通过发布本报告,我们真诚希望围绕“疫情时代国际航空运输业及航空保险业发展”的议题与各行业领域深入交流,凝聚共识,共同促进行业的实践探索,推动航空运输业、航空保险业的健康发展,为海南自贸区的建设贡献一份力量。

Through the issued of the report, we sincerely hope to have a deep exchanges with various industries on the topic of "The international aviation industry and aviation insurance industry development in the age of COVID-19", promote the practical exploration of the industry together and the healthy development of aviation industry&aviation insurance industry, contribute to the construction of Hainan free trade zone.

报告摘要

Executive Summary

自2020年初新冠疫情爆发以来,我们共同见证并经历了不平凡的一年。新冠病毒(COVID-19)在全球的流行导致了世界各地的航空客流量史无前例地大幅缩减。从财务角度来看,2020年将是国际民航运输史上灾难最深重的年度,伴随着数千航空企业的倒闭,目前已有数百万民航员工失业。

2020 has been a hugely challenging year for the aviation industry. The coronavirus (COVID-19) pandemic has led to unprecedented collapse of global passenger traffic impacting all regions of the world. Financially, 2020 will go down as the worst year in the history of aviation with substantial financial implications for the sector, millions of lost jobs and thousands of closed businesses.

新冠疫情对国际航空运输业的冲击Impact on Aviation Transportation

1、新冠疫情对国际航空运输业造成了史无前例的冲击。

The COVID-19 pandemic is having an unprecedented effect on the aviation industry.

2、旅行禁令和各种限制目前在世界范围内仍然普遍存在,导致了大量民航客机停飞。

Travel bans and restrictions remain in place and many aircraft are still grounded.

3、国际航协IATA预计2020全年行业总亏损将高达4190亿美元。

IATA estimate total revenue losses in 2020 of $419 billion.

4、2020年世界总航空旅客量已暴跌大约60%。

Circa -60% decline in world total passengers in 2020.

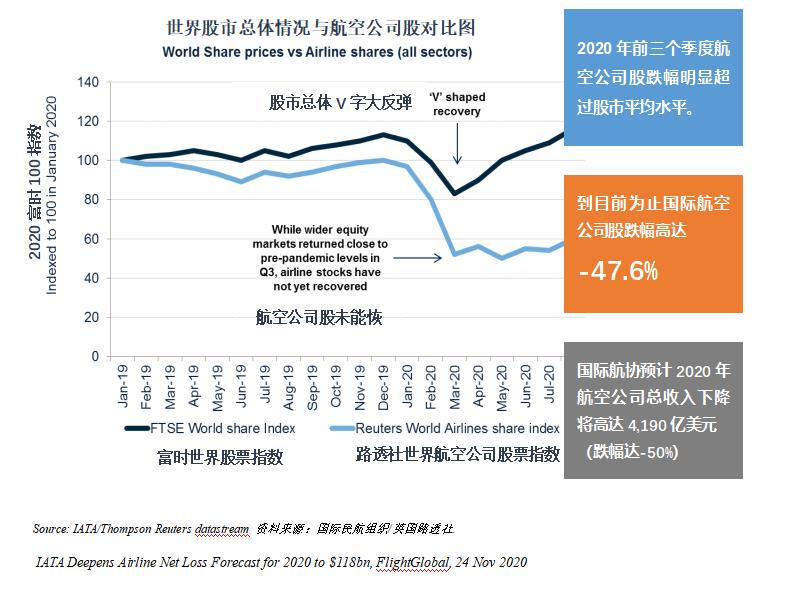

5、与去年同期相比世界主要航空公司股票下跌47.6%。

47.6% year to date decline in airline stocks.

6、航空运输业的性质与出行、旅游以及核心经济活动的其它许多方面紧密关联。

The aviation industry is inherently tied to travel, tourism and many other areas of core economic activity.

7、国际旅游业收入与2019年的15,000亿美元相比,在2020年的损失区间将高达9,100亿美元至11,700亿美元。

International tourism receipts have declined between $910 billion to $1,170 billion in 2020 compared to $1.5 trillion generated in 2019 worldwide.

新冠疫情对国际航空保险业的打击 Impact on Aviation Insurance

1、新冠疫情将导致今年成为国际保险市场损失最严重的年度之一。

COVID-19 will represent one of the worst ever claims years for the insurance market.

2、新冠疫情对于已经承受巨大业绩压力的国际保险人来说无疑是雪上加霜。

COVID-19 has accelerated trends which were already evident and brought added pressure on insurers.

3、全球公司业务量的削减以及客户对保费的折扣要求,将对2019和2020保险年度的保费收入均产生极其负面的影响。

Reduced exposures and premium relief measures will impact income on both the 2019 and 2020 policy years.

4、国际航空承保人不得不面对2020年度保费量下跌大约-25%的残酷现实。

Aviation insurers face a potential premium decline of circa -25% over their 2020 business plan forecasts.

5、航空企业客户的业务损失和破产倒闭也对未来年度的保费量和利润率造成巨大威胁,以至于国际保险企业必须将保证保费收入作为他们的首要任务。

Client failures and bankruptcies also remain a threat to future premium levels and profitability so protecting premium income is the key driver for insurers.

6、在新冠疫情影响下,全球大量飞机停航的事实导致了飞机在地面的风险积累,这已经成为了国际保险人非常担心的风险要素。

Impact of COVID-19 on global fleet means ground accumulation risk has become a serious concern.

7、展望未来,国际航空保险费率将很可能在2021年继续上涨。

Looking ahead, further rate acceleration in 2021 is likely.

本报告将从多个角度分析介绍航空运输业及航空保险业的发展,报告中所涉及的数据信息来自Cirium、标准普尔、Clyde & Co、夏礼文律师事务所、穆迪评级、民航资源网、亚洲保险论坛网、国际航协、联合国民航组织、CAPA世界机队数据库、国际民航组织、CAPA航空公司领导人杂志、FlightGlobal数据库等,本报告撰写过程中,也得到了Gallagher、Marsh的支持,在此表示感谢。

This report aims to analyze and introduce the development of air transportation industry and aviation insurance industry from various perspectives, part of the information disclosed are supplied and updated by Cirium, S&P, Clyde & Co, HFW, Moody’s, CARNOC, Asia insurance review.com, Flight Global etc, In the process of writing this report, we also received the support of Gallagher and Marsh, We hereby acknowledge with our thanks.

一、疫情时代的国际航空业

COVID-19’s Impact on International Airline Industry

1.1新冠疫情对国际航空运输业的总体影响

The Overall Impact of COVID-19 to International Airline Industry

2019年12月发现的一种新型冠状病毒,是以前从未在人类身体中发现的一种病毒株。世界卫生组织(WHO)已经宣布新型冠状病毒为全球卫生紧急事件。

In December 2019, a new form of the virus was discovered, which is a strain that has not previously been seen in human before. The World Health Organization (“WHO”) has declared Covid-19 a global health emergency.

突如其来的新冠疫情,给航空业带来灾难性的影响。在今年11月彭博社发表的一份国际航空业分析报告中指出,在不到一年的时间里,新冠疫情已经使全球的航线数量减少了近三分之一。全球运营航线已由1月下旬的47,756条降至11月的33,416条。此外,全球航班取消数量也呈大幅上升趋势,根据国际航空运输协会(IATA)的分析报告数据显示,截至今年10月12日,2020年世界航空客流量暴跌,航班取消数量为去年航班总数的50%,这是民航运输业所遇到的史无前例的灾难。

The sudden outbreak of the Covid-19 has brought disastrous impact to the aviation industry. In a report analyzing international airline industry issued by Bloomberg in November 2020, they stated that in less than a year, the pandemic has wiped almost a third of them off the map. In late January, 47,756 operational routes criss-crossed the world. By November 2nd, there were just 33,416 routes on global schedules, the data shows. In addition, the number of flight cancellations around the world is also increasing. According to the report of IATA, as of October 12th, the world passenger traffic collapsed and the number of flight cancellations this year was 50% of the total number of flights last year which witnessing its most unprecedented decline in history.

航线减少的同时,飞机需求也因此大幅下滑。波音公司在10月6日预测,疫情对航空需求的冲击在未来数年将变得较为严重,未来十年全球只需要18,350架新型商用飞机,比2019年的预测下降了10.7%。商用飞机市值将达到2.9万亿美元,比去年的预测下滑约2,000亿美。与此同时,在新冠疫情初期各国所采用的大规模封城和实施旅行限制直接导致了航空旅行需求的断崖式暴跌,各国航空公司不得不大量停飞其机队中相当数量的飞机,将运力降至最低以避免不必要的开销。

With the decrease of routes, the demand for aircrafts has also dropped sharply. Boeing predicted on October 6th that the impact of the epidemic on airline industry’s demand will become more serious in the next few years. In the next decade, only 18,350 new style commercial aircrafts will be needed, which is 10.7% lower than the 2019’s forecast. The market value of commercial aircrafts will reach 2.9 trillion USD, about 200 billion USD lower than 2019’s forecast. The initial response to COVID-19 of wide-scale lockdowns and strict travel restrictions saw air travel plummet as airlines grounded large parts of their fleets reducing capacity to the minimum.

新冠疫情对航空业收益的影响是巨大的。IATA 11月预计,全球航空运输业在2020年的净亏损将达到1,185亿美元,比6月份预计的数据增加了约342亿美元。同时根据这一预测,2021年新冠疫情将造成387亿美元的亏损,这远远超过行业在之前9/11事件和全球金融危机时的损失。

Covid-19’s impact on airline industry’s revenue is tremendous. IATA expected in November that the global airline industry to record a net loss of $118.5 billion in 2020, some $34.2 billion deeper than the figure it projected in June. IATA forecast that it will be followed by a $38.7 billion loss in 2021, which is much more than the industry lost in previous crises such as 9/11 and the global financial crash.

IATA首席经济学家布莱恩·皮尔斯(Brian Pearce)在协会年度股东大会当天的简报会中说到:“随着2021年上半年现金大量支出之后,该行业2021年的预计收入将达到危机前预期的50%。”

Chief economist of IATA Brian Pearce stated during a briefing on the day of the association’s AGM, “The airline industry’s revenue is projected to be 50% of pre-crisis expectations, after continued cash burn through the first half of the year.”

尽管航空运输仅占GDP相对较少的部分,但是其性质与人们日常生活紧密相连。航空产业的正常运行是开展其它许多经济活动的基石。

Air transport represents a small share of GDP but is closely linked to the activities of other sectors. The aviation industry is a key enabler of many other economic activities.

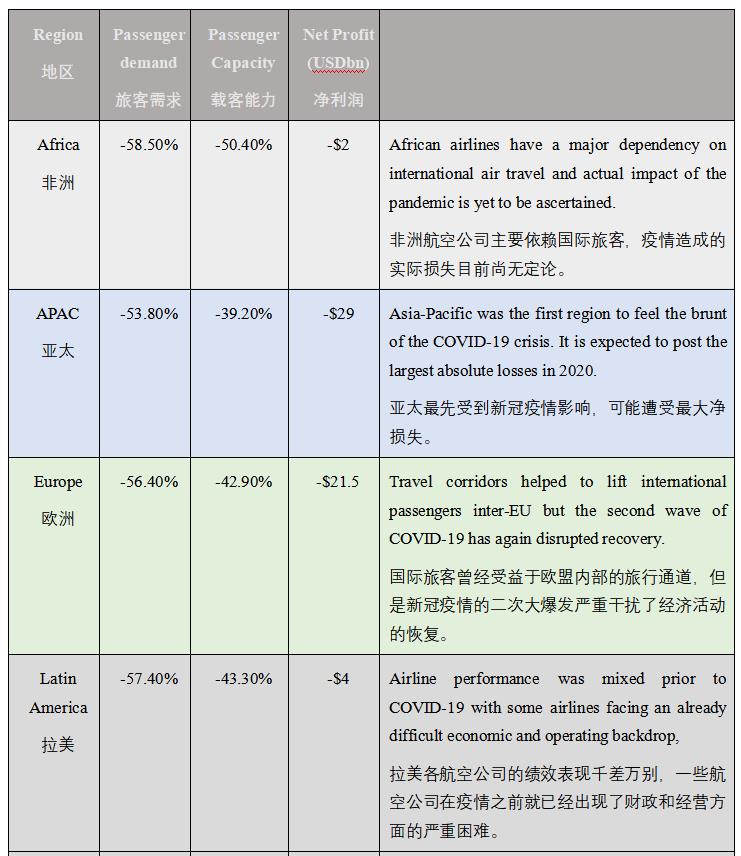

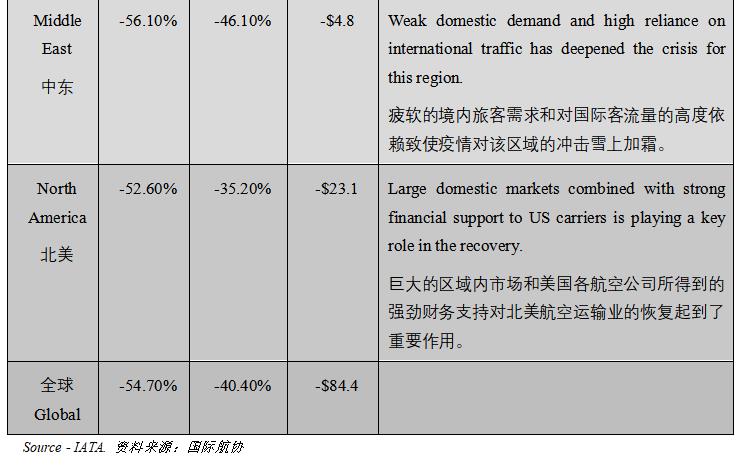

2020年新冠疫情冲击了全球,所有地理区域均遭受了不同程度的损失。

The crisis has impacted the world and all regions will post losses in 2020.

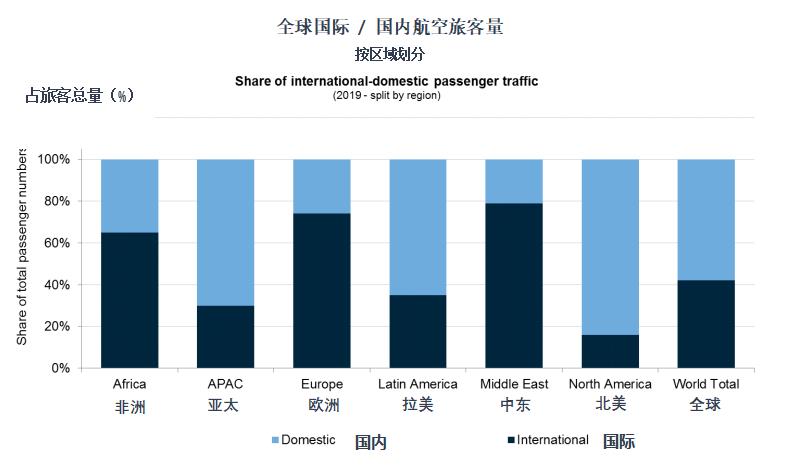

国际-国内航空旅客量在不同地理区域呈现了显著区别

International-domestic passenger split exhibits significant geographical disparity.

1.2新冠疫情对航空公司的影响

The Impact of COVID-19 to Airlines

受疫情的严重影响,全球航空需求急剧下滑,迫使各航空公司停飞大量客机,同时也加速了客机退役的速度,并使用最新、最高效的飞机继续进行飞行任务。有业内人士表示,虽然航空公司提前退役飞机并不会有直接的现金支出,但会对航空公司的资产价值造成比较大的影响。航空公司仍需为停飞的飞机支付贷款、停放费用、维护费用,这些会消耗本就紧张且急需的现金流。因此在这种情况下,航空公司会选择提前退役飞机,但由于现在没有多少人愿意接手,飞机的价值也就会远低于其应有的实际价值。因此,航空公司现在面临着一个挑战,就是决定要退役哪些飞机,同时根据逐渐复苏的需求重新启用哪些停飞的飞机。

For the reason of the epidemic, global demand on the aviation industry fell sharply, this has forced airlines to ground a large number of aircraft, but also to accelerate the retirement of aircraft, and to continue flights with the newest and most efficient aircraft. As mentioned by the expert, although there is no direct costs related to the retirement of aircraft, but the airlines’ assets value will be impacted. Since the airlines need to pay loans, parking fees and maintenance fees for the grounded aircraft, they will consume the tight cash flow. In this case, airlines will choose to aircraft’s early retirement. However, since there are less people willing to take over the aircraft, aircraft’s value would be far below their actual value. Therefore, airlines are now facing challenges of deciding which aircraft to retire, and re-enable grounded aircraft based on the growing demands.

此外,为节省现金开支,航空公司采取解雇/暂时解雇员工的措施。疫情爆发之前,航空运输业可提供约8,800万个就业机会和3.5万亿美元的GDP。然而,在新冠疫情的影响下,全球航空旅行需求暴跌,导致超过一半的就业和经济价值处于危险之中。10月份,航空业与周边行业的就业岗位较疫情之前减少了52.5%,与航空业直接相关的工作岗位与疫情之前相比减少了43%,这其中包括了航空公司、机场、制造商以及空中交通管理部门。

In addition, to conserve cash, airlines choose to lay off / furlough staff. Normally, this industry could provide about 88 million jobs and 3.5 trillion USD of GDP. However, because of the impact of the Covid-19 epidemic, demand of travelling plummeted, which resulting in more than half of the employment and global economy are in danger. In October, the aviation-supported jobs potentially fall by 52.5%, and direct aviation jobs (at airlines, airports, manufacturers and air traffic management) reduce by 43% compared with pre-Covid situation.

第三、各航司在客机上仅运营货运航班。以亚太地区为例,根据Cirium 9月的统计数据,今年一月至八月,亚太区航空公司运营了84,500架次纯货运航班。其中,中国大陆及港澳台地区占42%,北亚地区占37%。按照国家分类,货运航班量排名前三的是中国香港、中国大陆和韩国,他们各占亚太地区总货运航班的16-22%。相比之下,东南亚地区的航空公司占8%,大洋洲和南亚的航空公司则占6-7%。

Thirdly, each airline operate cargo only flights on passenger aircrafts. Taking Asia-Pacific as an example, Cirium September’s data for cargo-only flights tracked show that from January to August, operators in Asia-Pacific operated 84,500 pure cargo flights. Mainland China and other Chinese territories accounted for 42% of these operations, and North Asia, 37%. By individual countries, the top three operators for cargo-only flights are Hong Kong, mainland China, and South Korea, each accounting for 16-22% of all such flights among Asia-Pacific operators. In contrast, Southeast Asian operators take up just 8%, while those from Oceania and South Asia account for 6-7%.

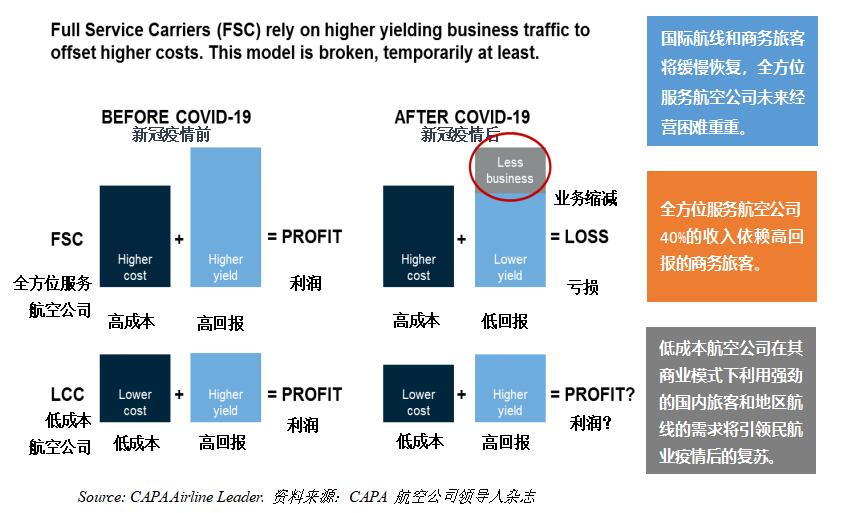

第四、全方位服务航空公司(FSC)依赖高回报业务量已抵消高成本。但这个商业模型已经暂时失效。新冠疫情很可能促使一些航空公司重新评估他们的商业模型。

Fourth, full service carriers rely on higher yielding business traffic to offset higher costs. This model is broken, temporarily at least. COVID-19 impact likely to cause some carriers to re-evaluate their business model.

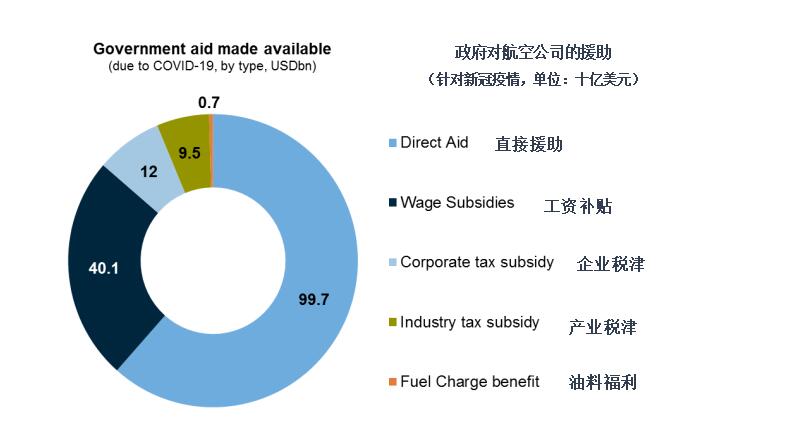

航空公司的生存依赖大量的融资活动、政府援助(1,600亿美元)以及供应商的补贴(200亿美元),在2020下半年(H2)现金消耗率的情况下,一个航空公司所持有现金的“中位数”只能使其坚持约8.5个月的运营。

Airlines have been kept on life support with large cash raises, government aid ($160 billion), and supplier subsidies ($20 billion). That said, the 'Median' airline's cash would last just another 8.5 months at the current H2 2020 Cashburn rate.

1.3新冠疫情对航空制造业的影响

The Impact of COVID-19 to Manufacturers

疫情之下,伴随着航空运输业的整体收益减少,航空制造业也随之减少产出、裁减员工,以及延期向航空公司交货。

With the decrease of overall revenue of airlines industry under the Covid-19 epidemic, manufacturers choose to reduce output in the long run, cut staff and support airlines with deferrals on deliveries.

具体到零备件方面,根据FlightGlobal的一篇分析报告,航空公司对二手零备件更为依赖。霍尼韦尔(Honeywell)亚太航空公司副总裁安德鲁·王(Andrew Wong)称:“由于新冠疫情,我认为他们的思维方式正在改变。在过去会看到很多航空公司都在考虑购买新的零备件,但是现在每个公司都在严格控制预算。”

According a report from FlightGlobal, one major change relate to spare parts is that airlines are showing greater openness on relying on used parts. “Due to the Covid-19, I think their mindset is changing in terms of buying behaviors,” says Andrew Wong, vice president of airlines Asia-Pacific at Honeywell.

此外,制造商正在开发并生产出更加卫生的机舱产品,以应对疫情时代航空运输业对卫生安全更高的要求。安德鲁·王在FlightGlobal的报告中提到,霍尼韦尔的UV客舱系统引起了航司的广泛关注。这个系统是一个外型酷似饮料车的便携式设备,它利用可伸缩臂发出的紫外线光(UVC)清洁飞机客舱表面的细菌。霍尼韦尔表示,这一系统源自医院使用的UVC系统,可以在所有主要机型上使用,并能够在不到10分钟的时间内清理完整个中型客舱。

Besides, manufacturers are developing more hygienic cabin offerings. Wong says in the report that, one item that has attracted considerable interest is Honeywell’s UV Cabin System, a portable device resembling a beverage cart that uses ultraviolet-c (UVC) light shining from extendable arms to kill germs on airplane cabin surfaces. The company said that this system is derived from UVC systems used in hospitals, the system can be rolled on and off all major aircraft types, and it can clear an “entire mid-sized airline cabin in less than 10 minutes.”

尽管已经开发出了更加卫生的机舱产品,但是对于航空公司而言,收益水平比卫生条件更为重要。霍尼韦尔还观察到一些航空公司除了通过退役部分机队来降低成本外,还推迟了一些非关键项目。

Although more hygienic products are developed, but cash is an even greater concern for airline bosses than hygiene. Honeywell has observed carriers delaying some non-critical projects, in addition to reducing network costs by retiring portions of their fleets.

ANALYSIS: Honeywell Sees Behavioral Shift among APAC Airlines, Cirium, 26 Oct 2020

根据Cirium Fleet Forecast(CFF)11月的分析报告,虽然目前航空业在行业低迷期和受到外部冲击时所表现出的很强的恢复能力尚难以抵消新冠疫情的影响,但航空运输人员和货物才是经济发展的关键因素。我们的交通模型假设在未来将面临一个缓慢恢复的过程,预计到2024年才能恢复到2019年的运输量水平,2024年之后将回归更传统的增长模式。同时CFF预计在2020年至2039年的20年里,将有43,315架新的客机和货机进行交付,总价值约为2.8万亿美元。这与2019年CFF对未来20年的预测相比降低了8%。

According to Cirium Fleet Forecast’s (CFF) report in November, however the aviation industry has proved resilient to previous downturns and external shocks, even though none have come close to the effects of the current pandemic. Transportation of people and goods by air is a key element of economic development. Our traffic modelling assumes a slow recovery, with 2019 traffic levels not being reached until 2024. Beyond 2024 we therefore expect to return to more traditional growth paths. Also, the 2020 CFF predicts that 43,315 new passenger and freighter aircraft deliveries will be made over the 20 years between 2020 and 2039, worth an estimated $2.8 trillion. These deliveries are 8% below the 20-year forecast in the 2019 CFF.

ANALYSIS: The 2020 Cirium Fleet Forecast, Cirium, 19 Nov 2020

1.4新冠疫情对租赁公司的影响

The Impact of COVID-19 to Lessors

受各航空公司收益的减少的影响,租赁公司根据具体情况,为航空公司提供延期付款的服务。这是由于对许多租赁公司和飞机融资公司而言,新冠疫情爆发的前几个月充斥着推迟交易的请求和租赁重组。Cirium的全球咨询总监罗布·莫里斯(Rob Morris)表示,租赁公司仍在忙于处理此类申请,在航空公司收入持续较低、政府对一些航空公司也不再支持的情况下,处理此类申请往往会变得更加复杂。

Impacted by airlines’ decreasing revenues, lessors support airlines with payment deferrals on a case by case basis. That is because for many lessors and aircraft financiers, the first few months of Covid-19 were a blur of rent deferral requests to field and deals to restructure. Lessors are still busy handling subsequent waves of such requests, which are often becoming more complicated while airline revenues remain low and government support for some carriers starts to run out, says Cirium’s global head of consultancy Rob Morris.

与此同时,租赁公司开始提供售后回租服务,以协助提升航空公司的现金流情况。以中银航空(BOC Aviation)为代表的几家租赁公司一直在向售后回租市场投入大量资金,即从航空公司购买飞机,然后再进行回租。其中一些交易规模相当大。国银航空租赁(CDB Aviation)的最新中期报告显示,今年上半年其售后回租活动激增至七笔交易,而在去年同期仅有一笔交易。

At the meantime, lessors started engaging in sale-lease back to assist with airline cashflow. Several lessors – notably BOC Aviation, for instance – have been pumping large sums of money into the leaseback market, purchasing aircraft from airlines and leasing them back. Some of these transactions have been sizable. Chinese lessor CDB Aviation’s latest interim report reveals that its sale-and-leaseback activity in the first half of this year skyrocketed to seven transactions, from just a single transaction in the same period last year.

ANALYSIS: Lessors Test the Market with Portfolio Sales, Cirium, 23 Sep 2020

1.5国际航空运输业恢复情况及地区间对比

Recovery of International Aviation Industry and Comparison among Regions

在近几个月中,全球航空业正在逐步恢复。以美国为例,截至目前,美国商业航空客运量恢复到疫情爆发前的一半以上。根据IATA最新的航空旅客市场分析,9月份收入客公里同比下降72.8%,但与8月份的75.3%相比略有改善。推动航空业复苏的主要因素是各国境内客运量的增加,但直至9月份,国际客运量仍然没有明显回升。国际长途航班数量始终偏低,并且增速较慢,境内/短途航班在大多数区域已经开始逐渐恢复。

Recently, the global aviation industry is gradually recovering. Taking the U.S. as an example, commercial airline traffic in the U.S. was back to more than half of pre-virus levels at the end of October. According IATA’s air passenger market analysis in November, industry-wide revenue passenger kilometers (RPKs) declined by 72.8% year-on-year in September, a small improvement from the 75.2% fall in August. The recovery remained mostly driven by domestic markets, while there was no clear recovery in international traffic in September. International (long haul) capacity remains very low, although growing slowly. Domestic / short haul capacity is gradually being reintroduced in most countries / regions.

根据IATA的分析报告,截至目前,各个国家的航班数量与2019年数据对比结果如下:中国恢复情况最佳,然而国际长途航班恢复情况仍然滞后;美国及拉丁美洲已恢复至去年的50%,其中国内航班及国际短途航班有所缓慢提升;欧洲已恢复至去年的40%,在7月份的时候曾有过增长趋势,但是随着疫情的二次爆发,目前又呈下降趋势。

According to IATA’s report in October, the result of comparing the number of flights in each country with the data in 2019 is as followed: China had the highest recovery rate,although long haul is still lagging; USA and Latin American obtained the proportion of 50%, they have gentle upwards trend for domestic travel and international short haul; Europe had a 40% capacity, with an upward trend in July, and now a downward trend due to second waves of the outbreak.

1.6国际航空运输业未来展望

Future Outlook of International Aviation Industry

疫苗的供应可能给国际航空运输业的发展带来变化。据11月份相关报道称,截至目前,有多种冠状病毒疫苗正在加紧争取获得监管机构的批准,预计最早可能在2021年中期推出,而对于普通大众而言,预估要到2021年下半年才可能接受针对旅行目的的疫苗接种,但在部分地区甚至会更晚。

The supply of vaccines may bring changes to the development of international aviation industry. According to reports in November, several types of corona-virus vaccines are stepping up to obtain regulators’ approval, which is expected to be launched as early as the middle of 2021. As for the general public, it is estimated that it will not be possible to have an inoculation for travel purposes until the second half of 2021, but in some areas it will be even later.

顾问公司IBA Group的斯图尔特·哈奇(Stuart Hatcher)在接受采访时表示,航空公司会尽力坚持到2021年复活节,届时飞行需求将会增加,疫苗也应当会推出,但资金储备在这之前就可能已经消耗殆尽。因此,疫苗研发的进展对航空旅行预订以及航空公司筹集资金的能力产生多大影响,仍需进一步探讨。

Stuart Hatcher of IBA group said in an interview that airlines will try to persist until Easter of 2021, when demand for flights will increase and vaccines should be available, but the capital reserves may have run out before that. Therefore, the impact of vaccine development on air travel booking and the ability of airlines to raise funds remains to be further discussed.

新冠疫苗终于见到曙光 许多航空公司却将倒在黎明之前,民航资源网,2020年11月24日

The new crown vaccine finally saw the dawn, many airlines will fall before the dawn, civil aviation resources network, November 24, 2020

新冠疫情的控制时间具有不确定性。许多国家自9月初开始又爆发了第二波疫情,让本已有所复苏的航空业再一次遭到冲击,国际航班数量也随之减少。2002年SARS爆发时,全球花了十一个月才完全将其“控制住”。而由于新冠病毒的传播范围远高于SARS,因此完全控制住新冠疫情也将会花费更长的时间。

The ‘containment time’ of Covid-19 is uncertain. The beginning of September saw the outbreak of second waves in many countries, reducing the international travel. In 2002, when there was an outbreak of SARS, it took 11 months to fully ‘contain’. Covid-19 will take longer as it is much more widespread.

疫情的影响也需要各航司思考如何让消费者回归,再次选择飞机作为自己的出行工具。目前,有航空公司正在游说在机场使用新冠快速检测,而非隔离检疫。有观点指出,“与在飞行途中感染新冠病毒相比,一个人在十二个月内遭受雷击的机会甚至要大得多。”因此,消费者和企业是否会因为此次疫情而改变长久以来的出行习惯,这是一个需要进一步探讨的课题。

The impact of Covid-19 need airlines to think deeply how to get passengers back, and to choose airplanes as their means of travel. Airlines are lobbying for rapid COVID testing to be utilized at airports instead of quarantines. It has been pointed out that “an individual has a much greater chance of being hit by lightning over a 12-month period than they do of catching Covid-19 during a commercial flight”. Therefore, whether consumers and businesses changed their long term travel habits need to be further discussed.

二、中国航空运输业的情况

Current Situation of Chinese Aviation Industry

2.1 中国航空运输业恢复情况

The Recovery of Chines Airlines Industry

中国航空运输业的恢复情况在全球处于领先水平。据民航资源网统计的数据,10月份,全行业共计完成运输航空飞行93.9万小时,恢复至去年同期的90.1%;民航运输生产恢复速度有所放缓,共完成运输总周转量86.7亿吨公里,恢复至去年同期的77.5%;同时,完成旅客运输量5,032.3万人次,恢复至去年同期的88.3%。

The recovery of China's aviation industry keeps ahead around the world. According to the statistics of CARNOC.com, in October, there are 939,000 flights hours in the whole industry, which showed a recovery of 90.1% comparing with the same period of last year. The recovery speed of civil aviation transportation production has slowed down, with a total turnover of 8.67 billion ton kilometers, and has recovered to 77.5% of the same period of last year. At the same time, it is estimated that there are 50.323 million passenger carryings, and has recovered to 88.3% of the same period of last year.

运输航空飞行量恢复至去年同期九成,民航资源局,2020年11月17日

Air traffic volume returned to 90% in the same period last year, CAAR, November 17, 2020

据中秋国庆假期期间的数据显示,国内日均旅客运输量恢复至去年同期9成。民航局局长冯正霖表示,假期期间,旅客运输量达到1,326万人次,日均旅客运输量恢复至去年同期91.07%,整体客座率恢复较好,平均客座率达78.64%,运输生产恢复强劲。

According to the data during the Mid-Autumn Festival and National Day holiday, the average daily volume of passenger traffic in China recovered to 90% in the same period of last year. Feng Zhenglin, director of the Civil Aviation Administration, said that during the holiday, the volume of passenger traffic reached 13.26 million, and the daily average passenger traffic volume recovered to 91.07% in the same period of last year. The overall passenger load factor is in a good condition, with an average passenger load factor of 78.64%, and the transportation production has a robust growth.

民航局:双节期间日均旅客运输量恢复至去年同期9成,中国民航网,202年10月10日

CAAC: the average daily passenger traffic volume recovered to 90% in the same period of last year during the double festival period.

2.2 各航司恢复情况对比

Recovery Status Comparison among Airlines

在国内飞行班次方面,10月份共保障各类飞行44.1万班,日均1.4万班,日均环比增加1.5%,恢复至去年同期的86.6%。其中,国内客运航班共执行40.8万班,同比增加8.1%。全国航班正常率为91.7%。受天气原因影响,共有11,286班延误,同比减少37%。

In terms of domestic aviation industry, there was 441,000 flights of various types in October, with an average of 14,000 flights per day, which increased by 1.5% comparing with the figure of last month. It showed a recovery of 86.6% comparing with the same period of last year. Including 408,000 domestic passenger flights, it showed an increase of 8.1% from the previous year. The rate of normal flights in China was 91.7%. And 11,286 flights were delayed because of the weather, with a decrease of 37% from previous year.

中国各航司在疫情当中的恢复情况也有所不同。据各大航司11月发布的经营数据显示:

The recovery of China's airlines under Covid-19 epidemic are different. The operational data released by airlines in November as follows:

10月,海航控股及其所属子公司客运运力投入同比减少46.25%,环比增长13.65%;旅客周转量同比减少47.79%,环比增长12.22%;旅客运输量同比减少38.47%至435.22万人,环比增长11.41%。

In October, the passenger transport capacity input of HNA holdings and its subsidiary companies decreased by 46.25% than last year and increased by 13.65% than last month; passenger turnover decreased by 47.79% than last year and increased by 12.22% than last month; passenger traffic volume decreased by 38.47% to 4.3522 million people, with a increase of 11.41% than last month.

10月,海航控股及其所属子公司的国内、国际客运运力投入分别同比减少28.49%、94.72%;旅客周转量分别同比减少33.61%、96.66%;旅客运输量分别同比减少34.29%、97.72%。海航控股及其所属子公司10月的客座率为80.1%,同比减少2.37个百分点,其中国内和国际的客座率分别同比减少6.25个、25.5个百分点至81.07%、43.81%。

In October, the domestic and international passenger transport capacity input of HNA holdings and its subsidiaries decreased by 28.49% and 94.72% respectively than last year; passenger turnover decreased by 33.61% and 96.66% respectively; and passenger transport volume decreased by 34.29% and 97.72% respectively. The occupancy rate of HNA holdings and its subsidiaries in October was 80.1%, with a decrease of 2.37 percentage points than last year, the domestic and international passenger ratios decreased by 6.25 and 25.5 percentage points to 81.07% and 43.81% respectively.

10月,中国国航及所属子公司旅客运输量为846.34万,同比下降13.8%,环比上升8.2%;客运运力投入同比下降29.2%,环比上升10.4%;旅客周转量同比下降35.3%,环比上升8.8%;

In October, Air China and its subsidiaries' passenger traffic volume was 8.4634 million, down 13.8% than last year and 8.2% than last month; passenger transport capacity investment decreased by 29.2% than last year and 10.4% than last month; passenger turnover decreased by 35.3% than last year and increased by 8.8% than last month;

其中,中国国航及所属子公司10月的国内客运运力投入同比上升13.7%,环比上升9.8%;旅客周转量同比上升2.6%,环比上升8.3%;旅客运输量同比上升3.6%,环比上升7.7%。国际客运运力投入同比下降93.2%,环比上升11.2%;旅客周转量同比下降96.1%,环比上升11.1%;旅客运输量同比下降96.8%,环比上升10%。地区运力投入同比下降79%,环比上升102.2%;旅客周转量同比下降87.1%,环比上升 428.4%;旅客运输量同比下降87.1%,环比上升414.3%。Among them, the domestic passenger transport capacity input of Air China and its subsidiaries in October increased by 13.7% than last year and 9.8% than last month; passenger turnover increased by 2.6% than last year and 8.3% than last month; passenger traffic volume increased by 3.6% and 7.7% year-on-year. The input of international passenger transport capacity decreased by 93.2% than last year and increased by 11.2% than last month; passenger turnover decreased by 96.1% than last year and increased by 11.1%; passenger traffic volume decreased by 96.8% than last year and increased by 10% than last month. Regional transport capacity input decreased by 79% than last year and increased by 102.2% than last month; passenger turnover decreased by 87.1% and increased by 428.4%; passenger transport volume decreased by 87.1% and increased by 414.3% than last year.

东方航空10月共运输旅客916万人次,其中运输国内旅客912万人次,恢复至去年的97.35%。公司客运运力投入(按可用座公里计)同比下降28.69%,其中国内航线客运运力投入同比上升9.65%,国际和地区航线运力投入分别同比下降95.16%和89.41%,旅客周转量(按客运人公里计)同比下降33.01%。国际和地区航线旅客周转量分别同比下降97.1%和94.21%;客座率为75.94%,同比下降4.9%,其中,国内、国际和地区航线客座率分别同比下降6.91%、30.55%和32.06%。

China Eastern Airlines carried 9.16 million passengers in October, including 9.12 million domestic passengers, up to 97.35% of last year. The company's passenger transport capacity input (based on available seat kilometers) decreased by 28.69% year-on-year, of which the domestic route passenger transport capacity input increased by 9.65%, the international and regional route transport capacity input decreased by 95.16% and 89.41% respectively, and the passenger turnover (calculated by passenger kilometers) decreased by 33.01% year-on-year. The passenger turnover of international and regional routes decreased by 97.1% and 94.21% respectively year-on-year; the passenger occupancy rate of domestic, international and regional routes decreased by 6.91%, 30.55% and 32.06% respectively.

南方航空10月载客1,188万人次,同比下降10.45%,环比增6.2%;客运运力投入(按可利用座公里计)同比下降19.07%,其中国内同比上升11.60%、地区和国际分别同比下降88.59%和89.95%;旅客周转量(按收入客公里计)同比下降25.59%,其中国内同比上升2.57%、地区和国际分别同比下降94.81%和93.15%;客座率为76.45%,同比下降6.70个百分点,其中国内、地区、国际分别同比下降6.81、36.01、25.98个百分点。

China Southern Airlines carried 1.88 million passengers in October, a decrease of 10.45% than last year and a increase of 6.2% than last month; passenger capacity input (based on available seat-kilometers) decreased by 19.07%, and increased by 11.60% within China decreased by 88.59% and 89.95% within the region and around the world respectively. Passenger turnover (based on revenue passenger kilometers) decreased by 25.59%, of which domestic turnover increased by 2.57%, regional and international turnover decreased by 94.81% and 93.15% respectively. The passenger load factor was 76.45%, with a decrease of 6.70% than last year, of which domestic, regional and international decreased by 6.81%, 36.01% and 25.98% respectively.

总体而言, Cirium预测亚洲市场将引领全球航空运输业的未来增长。其中,中国的航空旅客运输量增长率在未来20年将超过6%,中国将以22%的飞机交付占比成为最大的交付市场。其他亚太国家的总和占21%,北美和欧洲航空公司以20%和16%紧随其后,中东将占6%。

Overall, Cirium predicted that Asia markets will be the engine for growth and China is forecast to have the highest 20-year passenger traffic growth rate at over 6%. This will make it the largest single country for deliveries with a 22% share, ahead of all other Asia-Pacific countries, which have a combined 21% share. North American airlines follow with 20% and Europe with 16%. The Middle East will take a 6% share.

运输航空飞行量恢复至去年同期九成,民航资源局,2020年11月17日

Air traffic volume returned to 90% in the same period last year, CAAR, November 17, 2020

三、航空保险业的挑战与机遇

The Challenges and Opportunities of Aviation Insurance Industry

新型冠状病毒为全球各行业的发展前景带来了诸多不确定性,目前各国仍在集中精力控制新冠疫情的传播。虽然学术界针对病毒的源头和特点仍未有明确统一的定论,但风险和安全管理领域的专家团队已经开始研究如何保护企业与个人免受疫情的直接影响,以及如何积极应对各行各业供需减少的问题。

The outbreak of Covid-19 pandemic has impacted the global industry sectors in these times of uncertainty that many countries are focus on the response to control the pandemic transmission and their roles in the prevention policies on a global scale. Although there is no clear and unified conclusion on the source and characteristics of the virus in academic world, the risk and safety management experts have already started to investigate how to protect enterprises and individuals from the immediate effects of the pandemic and subsequent reduction in demand.

前文介绍了新冠疫情对于航空运输业的影响,由此引申出新问题:当航空运输总量出现下滑甚至停航时,是否会影响航空风险导致新的风险出现或引起风险级别提升,继而造成严重的安全管理问题?通过分析,我们可以判断外部环境的改变可能会引发财产受损、人身安全受威胁、监管不到位等问题。具体到航空运输业,可能出现的问题包括:

As described above the air transportation has been impacted by Covid-19, it brings to a new question: Could conditions arise or deteriorate enabling hazards to evolve whilst the volume of air transportation is reduced or locked down, which may cause severe safety management issues? Having analyzed we can tell how the external environment will change e.g. nsecured assets, physical security and integrity of restricted areas.

-安全管理系统无法及时辨识事故征候

-Safety management system is likely to be scaled back therefore hazards may be unidentified.

-因减少监管和运营资源方面的投入而对造成飞机损失

-Damage to aircraft due less oversight and resources

-检测结果的偏差,关键数据不足以及专业资质/许可证的缺失

-Erroneous test result, lack of data available to analyze, matching available licensed resources.

-防鸟、防外来物管理不到位导致的事故

-Increased attractants from unmanaged habitat may raise the likelihood of wildlife activity and FOD.

-在疫情期间提供旅客及货物运输服务时未能遵循各项法规的要求,需要依法承担赔偿责任

-Throughout the time of pandemic carriers will be legally liable to indemnify if failed to comply with regulatory requirements.

3.1 疫情对航空风险的影响 – 飞机机身

The Impact on Aviation Exposure - Hull

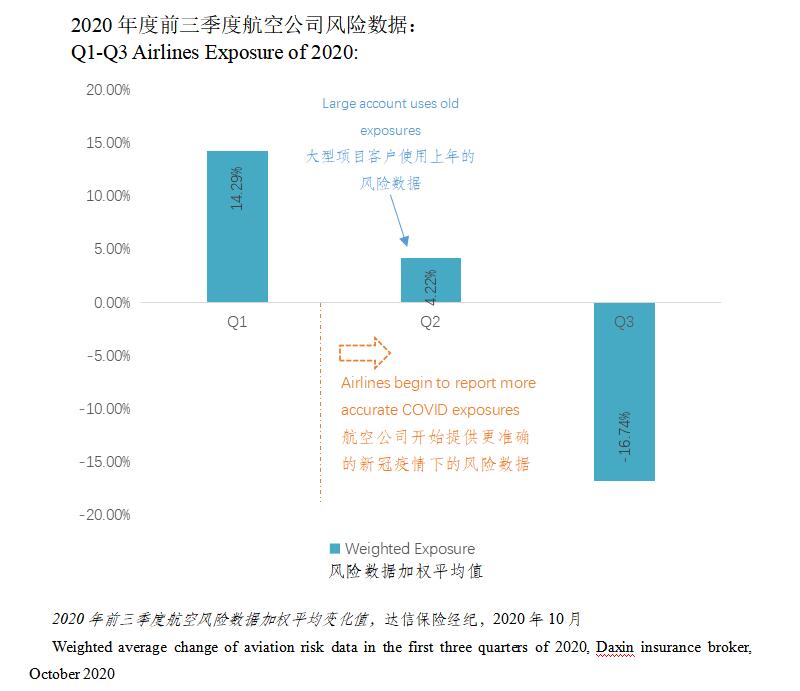

上文提到,进入2020年,新冠疫情曾一度导致全球60%的飞机停航。以Cirium统计的A320neo机型使用率情况为例,该机型在2019年11月日均执飞9.7小时,2020年11月则降低至7.3小时。此外,大量飞机停航或被封存,意味着风险数据也随之发生变化。在市场整体保费水平维持不变的情况下,航空险大型事故与中小型损失的出险几率都将显著减少。

As mentioned set forth above, entering into 2020, at the lowest point 60% world’s air fleet was grounded following the outbreak of Covid-19. Cirium reported that the in-service A321neo fleet’s daily flying hours utilization dropped by 25% over the period, from 9.7 at November 26 last year to 7.3 as of November 24 2020. In addition, while the premium base remains broadly similar, reduced operational activity should equal lower probability of catastrophic losses and attritional incidents.

Aviation industry weekly update – November 25, 2020, Cirium, 25 Nov, 2020

与此同时,那些使用效率较低,机龄较长,较大且折旧率/贬值率高的飞机将率先退出运营。Cirium针对窄体客运飞机执飞的航班数量进行了研究,结果显示航班数量相比2019年下降了35%,其中机龄不足五年的飞机执飞航班数量下降15%,而机龄超过十五年的飞机执飞航班数量下降了50%。疫情期间的飞行风险主要集中在更新、耗油表现更优异的飞机。

Meanwhile, less efficient, older and bigger aircraft, and those fully depreciated aircraft would be grounded first. Cirium tracked flights by narrowbody passenger jets, the investigation result show that jets less than five years old are down by less than 16% versus a fleet-level decline for nearly 35%, whilst narrow-bodies delivered more than 15 years ago have dropped by half. Flight exposure is continuing with the newer, more fuel efficient aircraft.

在制定承保保费与费率时,机身责任险与战争险承保人将结合飞机使用率、航班上座率等指标,适当调低保费定价策略。

When designating premium and rates, hull liability and hull war underwriters will amend the rating strategies considering the exposure such as daily hours, passenger capacity etc.

ANALYSIS: Flights data shows preference for young narrow bodies. Andrew Doyle, 19 Nov 2020

然而,大量飞机停飞可能造成单一地点(例如美国摩西莱克机场、维克托维尔机场在波音737 MAX飞机停航期间停放了大量该机型)风险过度集中。倘若在某个停放地点发生的单一事故造成大量飞机受损,总损失金额超过机身战争险保单的最高赔偿限额,则保险公司需要根据不同地点累计停放飞机的风险单位,重新设计保单保障,制定充足的保单限额。这一举措将有可能影响航空公司与机场的风险数据,需要市场提供更多航空险承保能力作为支持。

Nevertheless, Ground accumulation exposes insurers to a potentially higher possible maximum loss in single location (for example Moses Lake and Victorville airports in the United States, parked large numbers of Boeing 737 MAX aircraft during grounding). If a single location suffered a large number of aircraft damage, and the total loss amount the hull war policy limit, the insurers would needs to redesign the policy to establish sufficient recovery. This is likely to affect the exposure of airlines and airports which requires the market to provide more capacity in support.

值得一提的是,2020年11月18日,美国联邦航空局FAA正式批准波音737 MAX重新恢复商业飞行。经过20多个月的停航,该机型的调查研究终于取得重大进展,根据相关规定,航空公司在操作完必要的维修管理及飞行培训流程后,即可恢复飞机飞行。

It is worth mentioning that on 18 November 2020, the Federal Aviation Administration (FAA) has approved Boeing 737 Max available to the public. After more than 20 months grounding, the research now has huge development, as per regulated, it requires operators to conduct an AOA sensor system test and perform an operational readiness flight prior to returning each airplane to service.

波音737 MAX阅览室-适航指令摘要,联邦航空管理局,2020年11月18日

Boeing 737 MAX Reading Room - Airworthiness Directive Summary, the Federal Aviation Administration, 18 Nov 2020

3.2 疫情对航空风险的影响 – 旅客与货邮

The Impact on Aviation Exposure – Passenger, Cargo and Mail

旅客 Passenger

新冠疫情带来的新的挑战之一是旅客在被感染初期有可能具有潜伏期,因此,在起飞机场对出发旅客实施筛查排查尤为重要。即便如此,与其他传染性疾病相同,航空公司仍将面临许多与新冠病毒相关的潜在责任风险。其中包括:

One of the challenges presented by the 2019-nCov virus is the fact that infected passengers can seemingly spread the virus during the incubation period, before symptoms are showing. It is important that the departure airport has implemented exit screening for departing passengers. Even so, as with any communicable disease, there are a number of potential liability exposures for airlines in relation to the 2019-nCov virus. These include the following:

-登机时:未能拒绝出现新冠病毒类似症状的旅客登机;

At check-in: failing to deny boarding to a passenger showing symptoms consistent with potential 2019-nCov infection;

-在飞机上时:未能隔离出现新冠病毒症状的旅客,或未等待目的地医疗机构到场即让旅客下机;

On board: failing to isolate a passenger who is exhibiting 2019- nCov symptoms, or to await the attendance of medical authorities at the destination before disembarking passengers;

-在飞机上时:旅客因机舱空调系统故障而感染新冠病毒;以及

On board: passengers becoming infected with 2019-nCov due to a failure of the cabin air conditioning system; and

-飞行结束后:航空公司在收到通知称一架航班中的旅客确认感染新冠病毒后,未能追踪同航班的旅客。

Post-flight: failing to trace fellow passengers when the airline is notified that a passenger on one of its flights was diagnosed as having the 2019-nCov virus

事实上,在飞机上被患病者感染的风险较低。根据IATA的指南,感染的风险与在其他人员高度密集的密闭空间(例如公共汽车或影院)感染的风险类似。此外,大多数现代飞机都使用装有高效微空气(HEPA)过滤器的机舱空气过滤系统,该系统能有效地捕获与细菌和病毒同样大小的微小颗粒。

In reality, there is a low risk of contracting a disease from an ill person on board an aircraft. According to IATA, the risk is similar to that which exists in other confined areas with high occupant density, such as a bus or cinema. In addition, most modern aircraft use cabin air filtration systems equipped with HEPA filters, which are very effective at trapping microscopic particles as small as bacteria and viruses.

若旅客感染新冠病毒并且提出航空公司需要承担相应的法律责任,应遵循以下原则:

If passengers are infected with new coronavirus and the airlines need to bear corresponding legal responsibilities, the following principles should be followed

1、感染必须发生在航空运输期间。根据适用于航空旅行的国际航空公约(如1999年《蒙特利尔公约》)或等效的国家法律,这意味着要证明在飞行期间、登机或下机时被感染。在没有明确证据的情况下,则无法确定旅客是否在旅行前或旅行后的其他时间被感染。这可能包括旅客是在前往或离开机场的路上,登机排队、安检或边防检查站,或是在免税店被感染。若是在以上情形下被感染,航空公司不承担任何责任。显然,由于新冠病毒的潜伏期长达14天,在航空运输期间被感染的风险远远不及在其他地方被感染的风险。

The infection must have occurred during carriage by air. Under the international aviation conventions applying to air travel such as the Montreal Convention 1999, or equivalent national legislation, this means proving that the infection occurred either in flight, or during embarkation or disembarkation. Without clear evidence of this, it is always arguable that the passenger became infected at some other time, before or after travel. This would include infection on the way to or from the airport, or in check-in queues, at security or immigration check-points, or in duty-free shops. In those circumstances, the airline should not be held liable. Clearly, the incubation period for the 2019-nCov virus of up to 14 days increases the scope for infection to occur somewhere other than during carriage by air.

2、根据适用的国际航空公约,感染必须构成“事故”,航空公司才会产生相应责任。在许多司法辖区,“事故”被解释为与旅客无关的意外或不寻常事件。尽管很明显与旅客无关,但新冠病毒的传播是否会被视为意外或不寻常事件仍有待商榷。比如说,在飞行期间感染一种普通感冒病毒并不罕见,因此新冠病毒的情形与此并无不同(假设该等感染不是由他人故意或过失行为造成)。

The infection must constitute an “accident” for airline liability to arise under the applicable international aviation conventions. In many jurisdictions, an “accident” is construed as an unexpected or unusual event external to the passenger. Although clearly external, it is questionable whether the transmission of the 2019-nCov virus would be regarded as unexpected or unusual. By analogy, catching a common cold virus whilst flying is not unusual, and so the position in relation to the novel coronavirus should arguably not be any different (assuming that any such infection does not result from the deliberate or negligent act of another).

鉴于这些证据问题和缺乏法律认证,虽然航空公司可能会采取SARS爆发时期的处理方式,但由于新冠疫情导致少量索赔且索赔金额特别巨大的情形不太可能出现。

In light of these evident problems and lack of legal certainty, although some claims may arise, as with the SARS outbreak a flood of claims connected with the 2019-nCov virus seems unlikely.

尽管如此,机场和航空公司仍然应该采取切合实际且谨慎的措施来降低潜在风险,这些措施包括遵循由IATA或其他相关机构发布的指南。针对出现新冠症状旅客,提高预警机制尤为重要。若旅客出现明显的症状,应拒绝该旅客登机,以防止对其他旅客和机组人员的健康造成危害。所有感染新冠病毒的旅客都应以收到尊重并受到妥善的处置,特别是在医疗和检疫方面(根据《国际卫生条例》第31条和第32条)。

That said, it would be sensible for both airports and airlines to mitigate the potential risk of claims by adopting prudent measures. These include following the guidelines published by IATA and other relevant bodies such as those mentioned above. Increased vigilance for passengers displaying 2019-nCov symptoms is essential. In cases of apparent symptoms, passengers should be denied boarding in order to prevent a health hazard to other passengers and crew. Any such ill passengers should be handled appropriately, with respect for their dignity, especially in relation to medical treatment and quarantine (in accordance with Articles 31 and 32 of the International Health Regulations).

2019新型冠状病毒 – 航空视角,夏礼文律师事务所,2020年2月

2019 novel coronavirus, aviation angle, HFW, February 2020

另外,疫情期间航空公司取消大量航班,同时有可能需要面临受航班取消导致旅客的索赔。以欧盟为例,出发地机场或目的地机场为欧盟境内航班受 EC 261/2004法规的管辖,其中包括若航空承运人无正当原因导致航班取消,则航空公司因承担赔偿航班旅客的重任。Clyde & CO团队认为,新冠疫情属于航空公司无法预计或避免的“极端情况”,具有明显的不可抗力,因此航空公司显然不应为全球范围内数以百万计受疫情影响无法正常出行的航空旅客进行赔偿。然而,EC 261/04中提出,在必要的情况下,旅客有权获得航空公司提供的“信息,食物,洗漱,电话沟通以及住宿安排”,同时航空公司应在“条件允许的情况下提供退票或以其他方式将旅客送往原计划目的地”。

Apart from the above, throughout the pandemic flights were cancelled, these cancellations will have, and in particular, the potential claims passengers may make against airlines under the Regulation (EC) No. 261/2004, which as we know, governs flights from EU airlines departing from or arriving in the EU, as well as those of non-EU airlines departing from European soil. Airlines must pay compensation to passengers who affected by cancellations made without good cause. In Clyde and Co’s opinion, given that the cancellations have been imposed as a preventive measure to ensure public health at a global level, there is no doubt that we face an extraordinary circumstance that airlines could not have avoided, and therefore, there would be no right of compensation for the millions of passengers affected by such extraordinary circumstance. On the other hand, Articles 8 and 9 of Regulation (EC) No. 261/04 include the right of passengers to receive information, meals and refreshments, telephone calls, accommodation - if necessary - and, where appropriate, reimbursement or alternative transportation to their final destination.

COVID-19 Aviation: Compensation and assistance rights during Coronavirus, Clyde & Co, 13 March 2020

COVID-19航空:冠状病毒期间的赔偿和援助权,Clyde and Co,2020年3月13日

航空公司也应采取适当措施保护包括机组人员在内的工作人员,以避免工作人员感染新冠病毒而需要面临雇主责任索赔。这些措施包括允许机组人员佩戴口罩,在需要时提供其他防护装备,并确保机组人员接受适当的培训,并清楚知道在出现旅客确诊感染新冠病毒时须遵循的程序。

Suitable measures should also be taken by airlines to protect cabin crew, in order to avoid employers’ liability claims by any crew falling ill with the novel coronavirus. These measures may include allowing crew to wear face masks, providing other protective kit where required, and ensuring suitable training and understanding of the procedures to be followed where a passenger is displaying 2019-nCov symptoms.

货邮 Cargo and Mail

与客运航班的情况相比,由于疫情期间物资运送的便利与重要,航空业货物邮件运输的需求相对稳定。这一情况也反映航空运输业对货运飞机的需求增加,尤其是亚洲国家的货运航班数量上。

Compared with passenger flights, demand for cargo and mail transportation is fairly stable due to the convenience and importance of material transportation during the pandemic. This situation also reflects the increased demand for freighter aircraft, especially in Asian countries.

随着新冠疫苗的研发工作继续进行,包括航空在内的运输业正在开始制定疫苗的运输工作。而保险业也在着手应对史上最重要的航空货运计划以及随之而来的潜在风险。国际航协最近的调查发现,为全球人口提供数十亿剂疫苗,需要8000架波音747飞机负责运送。根据《蒙特利尔公约》规定的国际航空承运人责任,货物的损失赔偿额不应超过22个特别提款权,即每公斤货物约30美元。尽管新冠疫苗等药品的重量很轻,但价值很高。这意味着,现有的责任限额可能远低于疫苗的实际价值。保险公司和经纪人可能会重新审视航空公司保单下的保险条款,以确保航空公司在高价值货物运输的情况下得到足够的保护。

As the research and development of the new coronal vaccine continues, the transportation industry, including aviation, is beginning to formulate the transportation of vaccine. And also the insurance industry must now come to grips with the unique risks that may be created by the aviation sector undertaking one of the greatest logistical operations in human history. Recent figures from the International Air Transport Association suggest that the equivalent of 8,000 Boeing 747s will be needed in order to deliver the billions of doses required to vaccinate the global population. An analysis says that under the Montreal Convention — which governs a carrier's liability for international carriage — damage to cargo is limited to 22 special drawing rights, or approximately $30 per kilogram. The specific concern in relation to pharmaceutical products is that they are lightweight but high in value. This means that a shipment of vaccines can often have an extremely high actual value, yet the limit of liability under the Montreal Convention is very low in monetary terms. It said the insurers and brokers may wish to review the existing insurance provisions under airline all risks policies, to ensure that the airline is afforded sufficient protection in circumstances where high-value shipments are being carried.

在过去的几十年里,航空保险市场已经在其他重大事件中证实其能够应对航空业的新风险新问题,例如通过战争风险条款AVN52扩展承保战争和恐怖主义相关风险。尽管保险行业同样受到疫情影响,需要通过收取附加保费等方式确保其经营的效益与可持续性,保险公司在处理相关问题时仍然对航空公司提供了极大的支持。

The aftermath of many other major events over the last few decades have demonstrated the insurance community's ability to adapt to the ever-changing risk profile of the aviation industry — i.e., the Terrorism Risk Insurance Act, and AVN52 clauses adding passenger and third-party liability protection to principal liability coverage against war and terrorism risk.

3.3 2020年航空险市场情况分析 – 承保能力减少

Analysis of Aviation Insurance Market – Reduction in Capacity

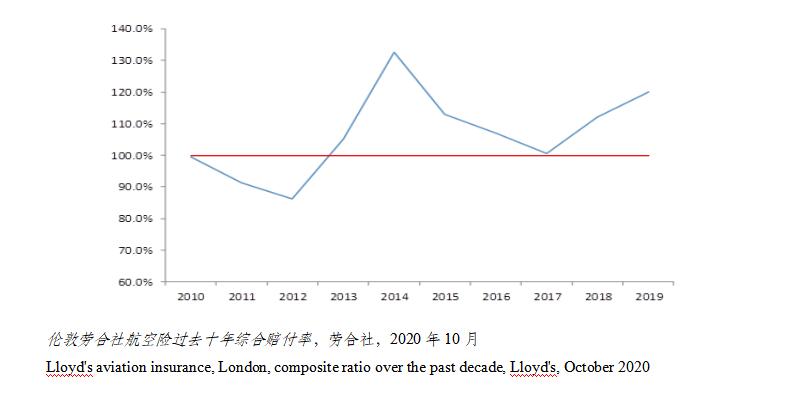

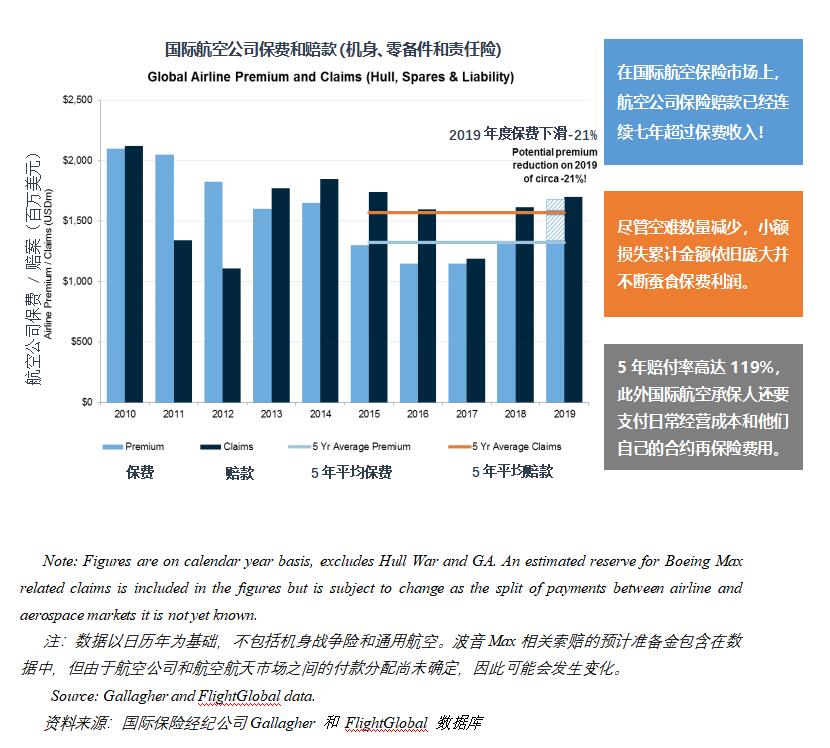

自2013年起,全球航空保险市场已经连续7年亏损,累计综合赔付率约为117.30%。长期的亏损状态,大型事故的不断发生以及过去两年内大量市场承保能力的撤出,导致全球航空险市场的保费水平连续上涨。数据显示2019年航空保险市场的总保费规模约为16亿美元,包括空难事故以及大型飞机制造商面临重大索赔,2019年总赔付金额约为17亿美元,短期内市场将仍然具有较大的不确定性和涨费压力。

Since 2013, the global aviation insurance market has not returned a profit in seven consecutive years, comprehensive loss ratio close to 117.30%. The frequency of serious accidents and the withdrawal of market capacity has led to premium increase. Data reflects that the 2019 aviation insurance market premium scale was circa USD1.6bn, in major accidents and manufacturers claims of greater value the total amount of losses might reach USD 1.7bn, the market still facing uncertainty and premium increase pressure.

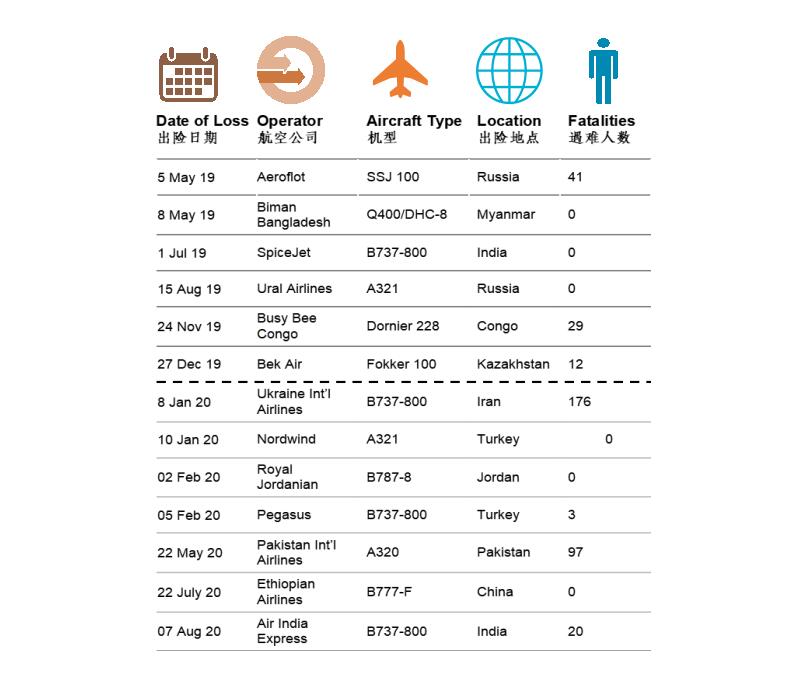

2020年,市场又陆续发生了乌克兰国际航空、巴基斯坦国际航空、埃塞俄比亚航空等大型事故,预计每一起事故的赔付金额都将在1000万美元以上。以下图表展示了过去18个月对航空保险市场影响较显著的航空事故,以及事故相关数据。

2020 saw an elevated level of airline claims including a number of significant events exceed USD 10m, including UIA, PIA and Ethiopian Airlines. The below diagram stipulates the information of major losses occurred in the past 18 months impacting the airline insurance environment.

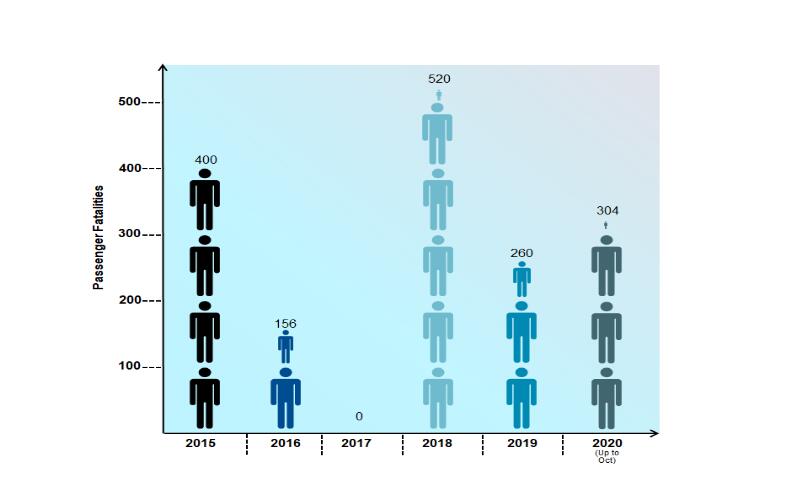

尽管2020年全球航空运输总量受新冠疫情影响锐减,与航空各类相关风险仍旧普遍存在。截至10月,2020年度航空公司旅客因意外死亡的个案为304人,这一统计数据甚至高于2019年的全年数据260人。

Despite the global air transportation suffered dramatic decrease following the outbreak of Covid-19, aviation risks will remain regardless of the new environment. Up to October 2020, the airlines incident fatalities of the year refers to 304 which is higher than the 260 in the whole year 2019.

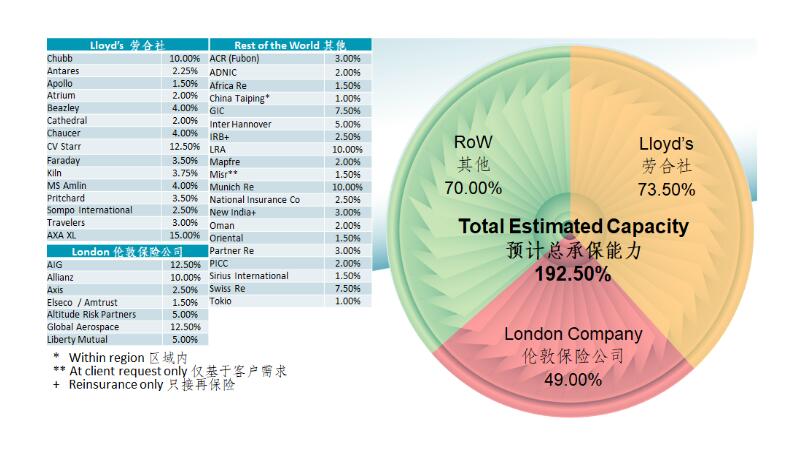

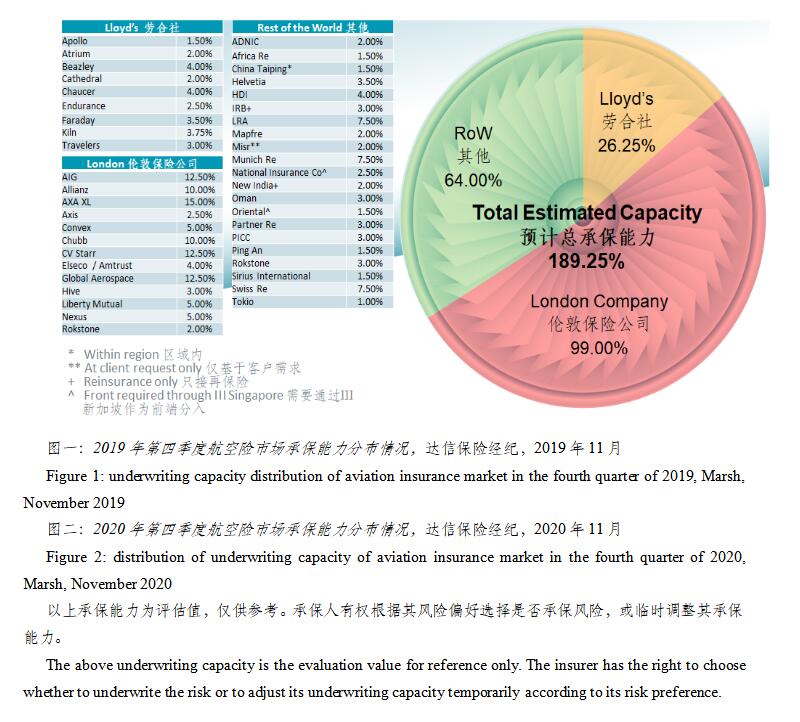

航空险综合赔付率的居高不下,导致大量市场承保能力撤出。最新统计显示,以承保综合单一责任限额15亿美元的非美国航空公司项目作为参照,目前国际市场能够提供的最大承保能力为189.25%。

The aviation insurance comprehensive loss ratio stays at a high level is causing a large number of underwriting withdrawing their capacity. The potential Maximum Line Size based on a benign non-US major airline with USD1.5 billion Combined Single Limit is estimated to be 189.25% in total.

航空公司保险市场概况 – 2019年10月:

Airline Insurance Market Overview – October 2019:

航空公司保险市场概况 – 2020年10月:

Airline Insurance Market Overview – October 2020:

2019年至今,国际航空保险市场经历了承保能力减少(如MS Amlin、Swiss Re、Asia Capital Re撤出)以及保险公司评级下降(如GIC Re、New India从A-降至B++)的冲击。

From 2019, International aviation insurance market has experienced the negative impact of reduced capacity (such as MS Amlin, Swiss Re, Asia Capital Re) and downgrade of the Insurers’ Financial Strength Rating (such as GIC Re, New India from A- to B++).

种种迹象显示,航空险市场仍将面对新冠疫情与全球经济衰退的双重影响,并可能出现以下情形:

There are signs that demonstrating the aviation insurance market will continue to be impacted by Covid-19 and the global economic recession, the following scenarios are likely to emerge in the future:

-企业间的并购、撤出市场及大规模裁员。

Prospect of further M&A activity, withdrawals and staffing cuts

-承保能力不足使保险公司在谈判中更加主动。

Increased awareness from Underwriters about their advanced negotiating position due to capacity risks

3.4 2020年航空险市场情况分析 – 保险保障的调整

Analysis of Aviation Insurance Market – Coverage Changes

疫情时期,保险业需要充分考虑航空公司在经营当中面对的困难。因此部分保险公司通过协商,同意调整保费分期支付的传统模式,积极配合航空公司,共同迎接挑战。

In light of pandemic, insurance industry shall take into consideration the airlines’ operational difficulties. Some insurers are showing willingness to reconsider traditional payment terms by negotiation, in order to cooperate with airlines to overcome challenges together.

行业普遍认为,鉴于过去7年保险市场的亏损情况,短期内市场费率/保费水平仍会继续上涨。飞机停航期间相比飞行期间的风险较低,而保费水平却仍保持相同标准。市场持续坚挺的状态将会继续延续至下一年的,除了导致保费上涨,承保人也将更加严格审慎的处理核保流程、并且持续收紧承保能力。

It is widely believed that there will be continuing hardening market leading to rising prices in the short term, in line with the market unprofitability in the past 7 years. Groundings have reduced exposure, while the premium base remains broadly similar. The current impact will be extended to next year, apart from the premium increase, we are also witnessing increased underwriter scrutiny leading to markets withdrawing / limiting their capacity deployment in a hard market.

2020年航空业饱受新冠疫情影响,从一个侧面反映出机场及相关机构(包括空中交通管理、地服、航油、航食供应商、维修厂等)可能在疫情期间出现的工作量增加、流程改变、人手不足等问题。保险公司在提供停航飞机的保险保障时同样需要考虑愈发复杂的风险。基于以上因素,2020年航空险市场在保险保障方面有以下变化:

The aviation industry was heavily affected by Covid-19, which from one side reflects the workload increase, process change and manpower shortage of airports and relevant parties (including air traffic control, ground handling, refueling, air catering and repairer, etc.) that may occur. Insurers also need to consider increasingly complex risks when providing insurance coverage for grounded aircraft. Based on above, the aviation insurance coverage would be affected in different ways including:

-新加入Global 350a条款,明确责任险保单停飞责任的适用条件

-Global 350a restriction in grounding coverage

-新加入LIIBA data event clause AV001,明确网络风险相关保障的适用条件

-LIIBA data event clause AV001 eliminating ‘silent cyber’ coverage

-新加入LMA 5391条款,列明与新冠疫情相关的保单除外责任(non-occurrence grounding)

-LMA 5391 which is commonly known as the Covid-19 Exclusion (non-occurrence grounding

本报告在总结新冠疫情对于航空保险业的影响时,需要特别强调以下方面:

It is necessary to emphasize the below aspects in this report, summarizing the Covid-19 impact on aviation insurance industry:

-航空公司可通过航空险AVN26——飞机停航退费条款向保险公司申请部分退费。由于保费基数的减少可能导致综合赔付率进一步上浮,这一条款对整体航空险市场的影响目前尚无法统计。作为航空公司坚实的支持者,保险经纪人会尽最大努力为客户争取合理退费的权益。

The premium base may be eroded due to refunds under AVN26. As the reduction of premium basis may generate worse comprehensive loss ratio, this effect is yet to be determined. As solid supporters of airlines, insurance brokers will make all efforts to endeavor to obtain reasonable returned premium for clients.

-个别运营受到重大影响的航空公司可能通过谈判取得整体保费的优惠,但承保人会在续转时整体考虑航空公司当前年度的实收保费和下一年度的续转保费,以保证自身持续经营所需的保费量。

Individual airlines whose operations are significantly affected may further negotiate a relief on the overall premium, but the insurer will take into account the insured's paid-up premium in the current year and the renewal premium will increase in the next year to ensure the income volume in a sustainable way.

-目前航空险市场承保能力整体不足,重大事故仍然时有发生,较有竞争力的承保人将驱动保费水平持续上升,直至保险市场此前多年的业务亏损问题得到解决。在现有市场形势下,保费与费率具有较大的上行风险。

The current market conditions associate with reduced capacity, occurrence of major losses, it will only be an increased availability of competitive capacity for each account that prevents the continued rise of premiums until the markets losses in previous years have been solved. At this point in the market, premium and rate increases are a reality.

3.5 2020年航空险市场情况分析 - 费率上涨

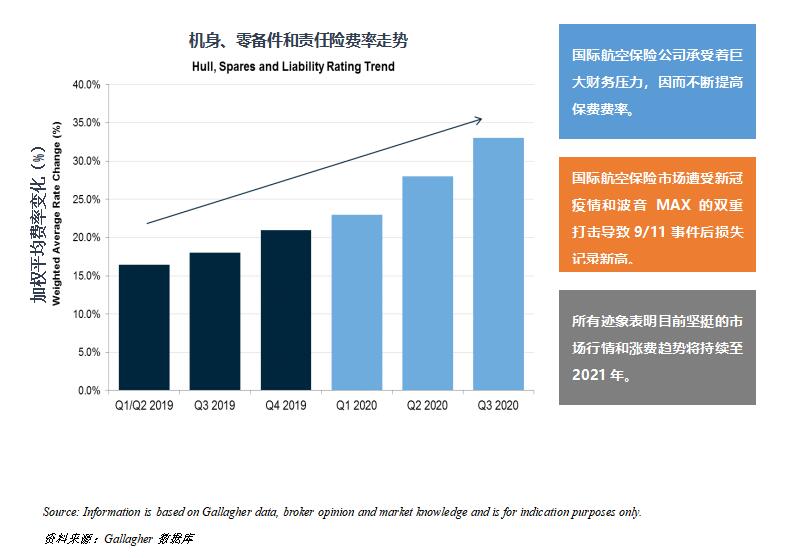

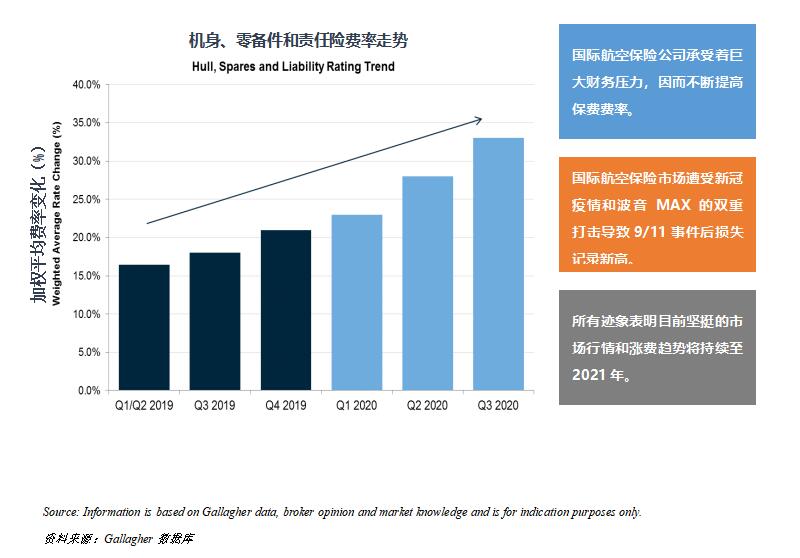

Analysis of Aviation Insurance Market – Rate Increase

航空公司机身及责任险市场走势Airline Hull and Liability Market Trend

2020年,在经历了持续数年疲软的买方市场和多次重大事故损失情况下,国际保险企业目前承受着盈利能力低下的巨大压力,新冠疫情对国际保险企业的打击可谓是雪上加霜。

In 2020, Insurers are under significant pressure to address poor profitability following a long and sustained soft market together with some exceptional claims activity in recent years, the COVID-19 pandemic has added further strain and pressures.

新冠疫情影响国际保险市场的定价环境

The impact of COVID-19 on the pricing environment of international insurance market

迄今为止,新冠病毒的全球大流行并未彻底改变国际保险市场定价的宏观商业环境。尽管国际承保人非常同情航空企业客户在疫情期间所蒙受的财务损失,但是每个保险企业本身也存在着生存的压力,迫使他们不得不致力于提高利润率,否则将面临破产或撤资的威胁。

To date, the COVID-19 pandemic has not changed the underlying market rating environment. Insurers are certainly sympathetic to the financial strain that the COVID-19 pandemic is having on aviation operators but are under their own pressures to improve underwriting profitability or face potential closure or withdrawal of capital.

由于新冠疫情导致国际民航经营活动的显著下降,到目前为止,累计航空事故赔案金额尚且低于去年同期水平。尽管如此,2020年度依旧事故不断并且发生了一些重大空难和地面损失,涉事企业包括:航空公司、飞机维修与制造、通用航空等领域。这证明了即使航班数量下降,也无法降低航空运营的潜在事故风险。

The overall aviation loss figures remain lower than those recorded for the same period last year due in part to the significant reduction in operations seen as a result of the ongoing pandemic. That said, we have continued to observe claims throughout 2020 with some significant losses and ground incidents seen across the airline, aerospace and general aviation segments. Ultimately this demonstrates that despite reduced numbers of aircraft movements, the underlying risk inherent in aviation has not decreased.

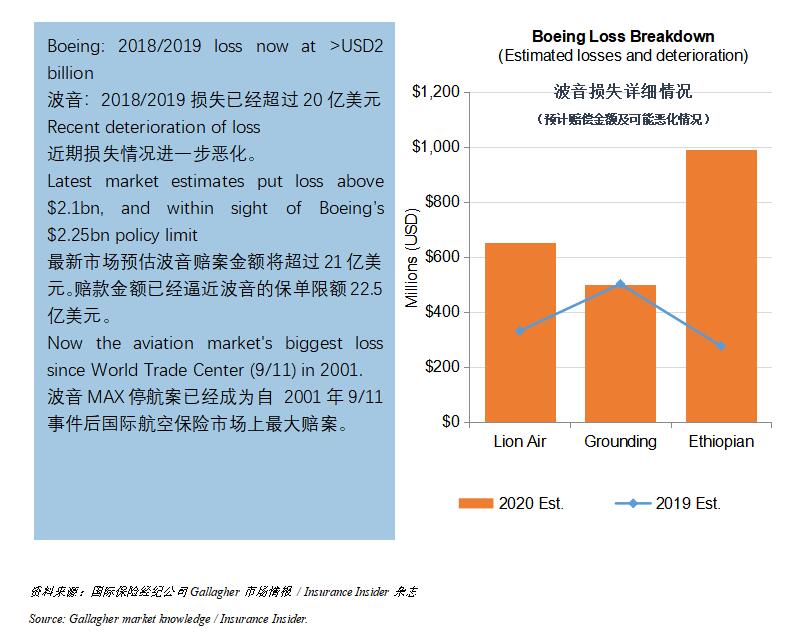

波音MAX相关损失与再保险成本的上涨

Boeing MAX loss and rising reinsurance costs

关于波音MAX飞机长期未解的技术问题和错综复杂的理赔案件正在对国际航空保险市场造成巨大的冲击。到目前为止据业界估计,国际合约再保险市场将赔偿至少15亿至17亿美元的损失。这造成了航空承保人的利润缩减因而迫使他们继续抬高费率持续当前市场的涨费趋势。

The long-running and complex claims involving the Boeing Max aircraft is having a significant impact on current market conditions. It is estimated the reinsurance market will pay at least $1.5bn-$1.75bn of the loss which is putting further squeeze on insurer margins and keeping pressure on the current rating trend.

新冠疫情导致地面风险的累积

COVID-19 heightened ground accumulation risk

由于疫情期间航空客流量的巨幅下降,大量民航客机停飞或入库封存,致使2020年度民航飞机在地面大规模聚集,这使国际航空承保人十分担忧。尤其是对于那些自然灾害频发和战争冲突不断的国家和地区,大量飞机停放在地面就尤为危险。

With large parts of the commercial aviation fleet grounded and higher numbers of aircraft parked or in storage due to the drastic reduction in traffic from COVID-19, ground accumulation risk has become a serious concern for aviation insurers in 2020. The heightened risk to insurers of aircraft on the ground is significant especially in those countries and regions deemed more susceptible to extreme weather events and or those based in 'hot-spots' or higher risk areas.

3.6国际航空保险市场发展趋势

Development trend of international aviation insurance market

•2021年国际航空保险市场继续保持坚挺并伴随着费率的进一步上涨。

•In 2021, the international aviation insurance market continues to harden and rates are increasing.

•新冠疫情加剧了涨费趋势,而总保费下降,并带给承保人更多压力。

•COVID-19 has accelerated trends which were already evident, while the total premium decreased, and brought added pressure on insurers

•2021年度国际市场承保能力进一步下降并且在某些险种领域尤其紧张。

•Capacity levels have reduced further in 2021 and are strained in some segments

•尽管全年重大空难总数有所下降,然而我们看到航空事故仍旧不断发生。

•Overall aviation loss activity has reduced but we continue to observe claims

•对于每次保险续转,承保人开价时均基于区别对待不同客户的原则,这就意味着对客户资质甄别的重要性。

•Each renewal and insurer offering is viewed on a case-by-case basis making risk differentiation critical

•利润率和保费收入则是承保人业绩的重要指标。

•Profitability and protecting premium income is the key driver for insurers

•今年第四季度市场情况将对全年结果和未来走势至关重要。

•The results of the fourth quarter are crucial to the year-end results and future trending

结语

Concluding Remarks

2020年即将结束,新的一年即将到来,随着新冠疫情的不断变化,我们会持续关注国内、国际航空运输业与航空保险业的最新情况。本报告中涉及的观点与意见,均由行业专家以及第三方机构提供,具有较强的针对性、专业性。通过发布本报告,我们真诚希望围绕“疫情时代国际航空运输业及航空保险业发展”的议题与各行业领域深入交流,凝聚共识,运用专业手段推动航空运输业、航空保险业的健康发展。

2020 is coming to an end and a new year is coming, As the situation of Covid-19 pandemic changing variability, we will continuously pay concern to the latest impact on international air transportation industry and aviation insurance industry. The viewpoints and opinions stated in this report are provided by industry experts and third-party institutions, which are considered to be relatively specific and professional. By issuing this report, we sincerely wish to deepen exchanges and build consensus with all industry sectors around the theme of “the international aviation transportation industry and aviation insurance industry development in the age of COVID-19”, make full use of our profession and wise to promote the development of aviation transport industry and aviation insurance industry healthily.

鸣谢Acknowledgement

本报告从多个角度分析介绍航空运输业及航空保险业的发展,报告中所涉及的数据信息来自Gallagher、Marsh、Cirium、标准普尔、Clyde & Co、夏礼文律师事务所、穆迪评级、 民航资源网、亚洲保险论坛网、国际航协、联合国民航组织、CAPA 世界机队数据库、国际民航组织、CAPA 航空公司领导人杂志、FlightGlobal 数据库等,在此表示感谢。

This report aims to analyze and introduce the development of air transportation industry and aviation insurance industry from various perspectives, part of the information disclosed are supplied and updated by Gallagher、Marsh、 Cirium, S&P, Clyde & Co, HFW, Moody’s, CARNOC, Asia insurance review.com, Flight Global etc, We hereby acknowledge with our thanks.

扬子江保险经纪有限公司

Yangtze River insurance brokers Co., Ltd

扬子江保险经纪有限公司于2003年11月经原中国保险监督管理委员会批准在北京注册成立,注册资本金5000万元人民币,是一家全国性保险经纪公司。

Yangtze River insurance brokers Co., Ltd. was registered in Beijing in November 2003 with the approval of the former China Insurance Regulatory Commission. With a registered capital of 50 million yuan, it is a national insurance brokerage company.

扬子江保险经纪公司为中国大陆、中国香港、法国、土耳其及加纳等海内外数百家企业提供高品质的风险咨询管理、保险和再保险经纪服务。截至目前累计为超过2万亿元的项目提供风险咨询及管理,服务客户逾388万人次,累计处理案件近24万起。

Yangtze River insurance brokers provide high quality risk consulting management, insurance and reinsurance brokerage services for hundreds of Chinese mainland and Mainland China, Hongkong, France, Turkey and Garner. Up to now, it has provided risk consultation and management for more than 2 trillion yuan of projects, served more than 3.88 million customers and handled nearly 240000 cases.

扬子江保险经纪公司以卓越的风险管理技术和领先的专业能力,通过产品创新、科技创新、服务创新,充分满足各类客户的需求,努力将企业打造成为行业领先的“科技驱动型、风险管理型、价值创造型”的专业化、国际化的保险经纪公司。

With excellent risk management technology and leading professional ability, Yangtze River insurance brokers fully meets the needs of various customers through product innovation, technological and service innovation, strives to build the company into a leading professional and international insurance brokerage company with "technology driven, risk management and value creation".